In Wisconsin, car insurance is a legal requirement for all drivers. If you own a vehicle and plan to drive it on public roads, you must have a valid car insurance policy that meets the state’s minimum coverage requirements. Here are some key points to know about car insurance in Wisconsin:

Liability Coverage:

Wisconsin law requires drivers to carry liability insurance, which covers damages or injuries to others if they are at fault in an accident. The minimum liability coverage limits in Wisconsin are commonly referred to as “25/50/10,” which means you must have at least:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

Uninsured Motorist Coverage:

Wisconsin also mandates uninsured motorist coverage (UM) and underinsured motorist coverage (UIM). UM coverage protects you if you are in an accident caused by a driver without insurance, while UIM coverage comes into play if the at-fault driver’s insurance coverage is insufficient to cover your damages.

Proof of Insurance:

You must carry proof of insurance whenever you drive and present it if requested by a law enforcement officer or after an accident. Most drivers carry a physical insurance card, but electronic versions on smartphones or other devices are also acceptable.

Optional Coverages:

While liability coverage is mandatory, there are additional optional coverages you can consider, such as collision coverage (covers damage to your vehicle in an accident) and comprehensive coverage (covers non-accident-related damages like theft, vandalism, or natural disasters).

Penalties for Non-Compliance:

Failure to maintain car insurance in Wisconsin can result in fines, license and registration suspension, and potential criminal charges. It’s essential to keep your insurance policy active and up to date.

Insurance Rates:

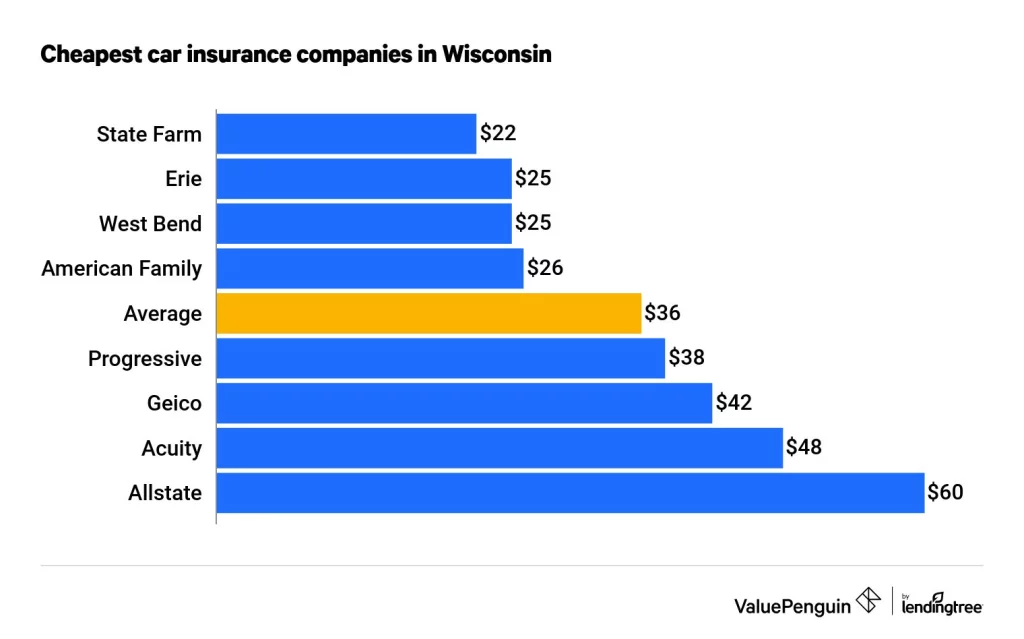

The cost of car insurance in Wisconsin can vary based on factors like your driving record, age, location, the type of vehicle you drive, and the coverage options you choose. It’s a good idea to shop around and compare quotes from different insurance providers to find the best coverage at the most affordable rate.

Average Fee of Car Insurance in Wisconsin

The average cost of car insurance in Wisconsin can vary depending on several factors, including your age, driving record, location, type of vehicle, coverage limits, and deductibles. Insurance premiums are personalized, and there is no one-size-fits-all answer. However, I can provide you with some general information.

According to data from the National Association of Insurance Commissioners (NAIC) for 2023, Wisconsin drivers pay $1,292 per year for full coverage and $358 per year for minimum coverage. In terms of monthly rates, this breaks down to an average of $108 per month for full coverage and $30 per month for minimum coverage. Keep in mind that this is an average, and the individual rate can be higher or lower based on the factors mentioned earlier.

To get a more accurate estimate of car insurance rates in Wisconsin, it’s best to contact insurance providers directly and request quotes based on your specific circumstances. Insurance companies will consider various factors to calculate your premium, so rates can differ significantly from person to person.

Additionally, it’s worth noting that car insurance rates can change over time due to various factors, such as market conditions, insurance company policies, and individual risk assessments. Therefore, it’s essential to compare quotes from multiple insurance providers to find the most competitive rates for the coverage you need.

Best Car Insurance Firms in Wisconsin

There are several well-known car insurance companies that operate in Wisconsin. While the “best” insurance firm can vary depending on individual needs and preferences, here are some reputable companies that consistently receive positive reviews and ratings:

- State Farm: State Farm is one of the largest car insurance providers in the United States and is known for its extensive coverage options, competitive rates, and excellent customer service.

- American Family Insurance: American Family Insurance is a Wisconsin-based company and is highly regarded for its personalized service, wide range of coverage options, and strong presence in the state.

- Progressive: Progressive is known for its innovative approach to car insurance and offers a variety of coverage options, including usage-based insurance programs like Snapshot. They are known for their competitive rates and easy-to-use online tools.

- GEICO: GEICO is a well-known insurance company that often provides competitive rates and offers a simple and streamlined online experience. They have a strong presence nationwide and are known for their advertising campaigns.

- Allstate: Allstate is another popular insurance company with a wide range of coverage options and a network of local agents. They offer various discounts and features like accident forgiveness and deductible rewards.

These are just a few examples of car insurance companies that operate in Wisconsin and are generally well-regarded. It’s important to research and compare quotes from multiple insurance providers to find the one that best suits your specific needs in terms of coverage, price, customer service, and overall satisfaction.

Remember that this information is a general overview; specific insurance policies and rates can vary. It’s always recommended to consult with an insurance agent or company directly to get accurate and up-to-date information tailored to your needs.