Car insurance is a legal requirement in most countries and is designed to protect drivers financially in case of an accident.

There are different types of car insurance policies available, such as liability insurance, collision coverage, and comprehensive insurance.

The cost of car insurance depends on various factors, including the driver’s age, driving record, location, and the type of car they own.

It’s important to compare different insurance policies and providers to find the best coverage for your needs and budget.

What is Car Insurance and how it works?

Car insurance is a contract between you and an insurance company, where you pay a premium in exchange for protection against financial loss in case of an accident, theft, or other damages to your vehicle.

When you purchase car insurance, you select coverage options that determine the types of incidents that the insurance company will pay for. For example, liability insurance covers damages you cause to another person or their property, while collision coverage covers damages to your own vehicle in an accident.

If you are involved in an accident, you would typically file a claim with your insurance company to request payment for damages. The insurance company will investigate the claim and determine whether it is covered under your policy. If the claim is covered, the insurance company will pay for the damages up to the limits of your policy. You may be required to pay a deductible before the insurance company pays out.

It’s important to note that the cost of car insurance varies based on several factors, such as your driving record, age, gender, location, and the type of car you drive. To get the best coverage at the most affordable price, it’s important to shop around and compare insurance policies from different providers.

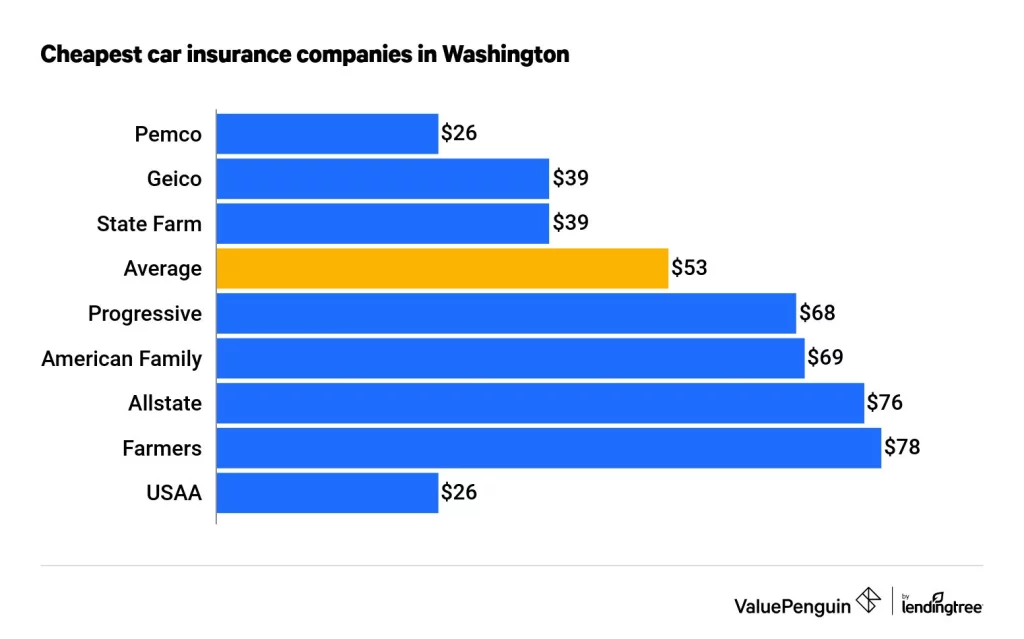

Average Cost of Car Insurance in Washington

The average cost of car insurance in Washington is around $700 to $800 per year for minimum liability coverage, and around $1,400 to $1,500 per year for full coverage, which includes liability, collision, and comprehensive coverage.

However, the actual cost of car insurance can vary depending on several factors, such as your driving record, age, gender, location, the type of car you drive, and the coverage options you choose. It’s always a good idea to compare quotes from multiple insurance providers to find the best coverage at the most affordable price.

Requirements of Car Insurance

Car insurance is an important investment for any vehicle owner, as it offers protection against financial losses that may arise from accidents, theft, or damage to the car. The requirements of car insurance can vary from country to country, but here are some common requirements that are necessary for most car insurance policies:

Liability Coverage:

Liability coverage is a legal requirement in most countries, and it covers the costs of any damage or injury caused to third parties in the event of an accident. It includes both bodily injury liability and property damage liability.

Collision Coverage:

Collision coverage is optional in some countries, but it is a good idea to have it if you want to protect your vehicle from damages caused by an accident with another car or object.

Comprehensive Coverage:

Comprehensive coverage is also optional, but it covers a wide range of damages that are not related to accidents, such as theft, vandalism, natural disasters, and falling objects.

Personal Injury Protection:

Personal injury protection (PIP) is a type of coverage that pays for medical expenses and lost wages for you and your passengers in the event of an accident. PIP is mandatory in some countries, while it is optional in others.

Uninsured/Underinsured Motorist Coverage:

Uninsured/underinsured motorist coverage is also an optional coverage that protects you in case you get into an accident with someone who does not have insurance or does not have enough insurance to cover your damages.

Deductible:

A deductible is the amount of money you have to pay out of your own pocket before your insurance coverage kicks in. A higher deductible can result in lower premiums, but it also means that you will have to pay more if you get into an accident.

Best Car Insurance Companies in Washington

There are many automobile insurance companies in Washington, and the best one for you will depend on your individual needs and budget. However, based on customer satisfaction ratings and financial strength ratings, some of the top automobile insurance companies in Washington include:

State Farm – State Farm is the largest automobile insurer in Washington and has an A++ financial strength rating from AM Best.

Nationwide – Nationwide has high customer satisfaction ratings and an A+ financial strength rating from AM Best.

Geico – Geico is known for offering affordable rates and has an A++ financial strength rating from AM Best.

Allstate – Allstate has a strong financial rating and offers a range of coverage options.

It’s important to compare quotes from multiple insurance providers and read reviews from customers to find the best automobile insurance company for your needs.

In conclusion, car insurance requirements can vary depending on the country and the insurance company you choose. It is important to carefully review and understand the coverage options and requirements of your car insurance policy to ensure that you are adequately protected.