In Tennessee, like in most states, having car insurance is mandatory. The state requires drivers to carry a minimum level of liability insurance coverage to legally operate a vehicle. Here is some information about car insurance in Tennessee:

The minimum liability coverage required in Tennessee is often expressed as 25/50/15. This means you must have at least:

$25,000 bodily injury liability coverage per person injured in an accident

$50,000 bodily injury liability coverage per accident for all persons injured

$15,000 property damage liability coverage per accident

Uninsured/underinsured motorist coverage:

Tennessee also requires drivers to have uninsured motorist coverage with limits matching the liability coverage unless you reject this coverage in writing.

This coverage helps protect you in case you’re involved in an accident with an uninsured or underinsured driver.

Proof of insurance:

You must carry proof of insurance while driving in Tennessee. This can be in the form of an insurance card provided by your insurance company.

If you are pulled over by law enforcement or involved in an accident, you may be asked to present proof of insurance.

Penalties for driving without insurance:

Failure to carry the required minimum insurance in Tennessee can result in penalties, including fines, suspension of your driver’s license, and vehicle registration.

Optional coverage:

While the state mandates minimum liability coverage, you may want to consider additional types of coverage for more comprehensive protection.

These may include collision coverage (for damage to your own vehicle), comprehensive coverage (for non-accident-related damages, such as theft or vandalism), medical payments coverage (for medical expenses resulting from an accident), and more. Optional coverages can vary depending on the insurance provider.

Insurance rates:

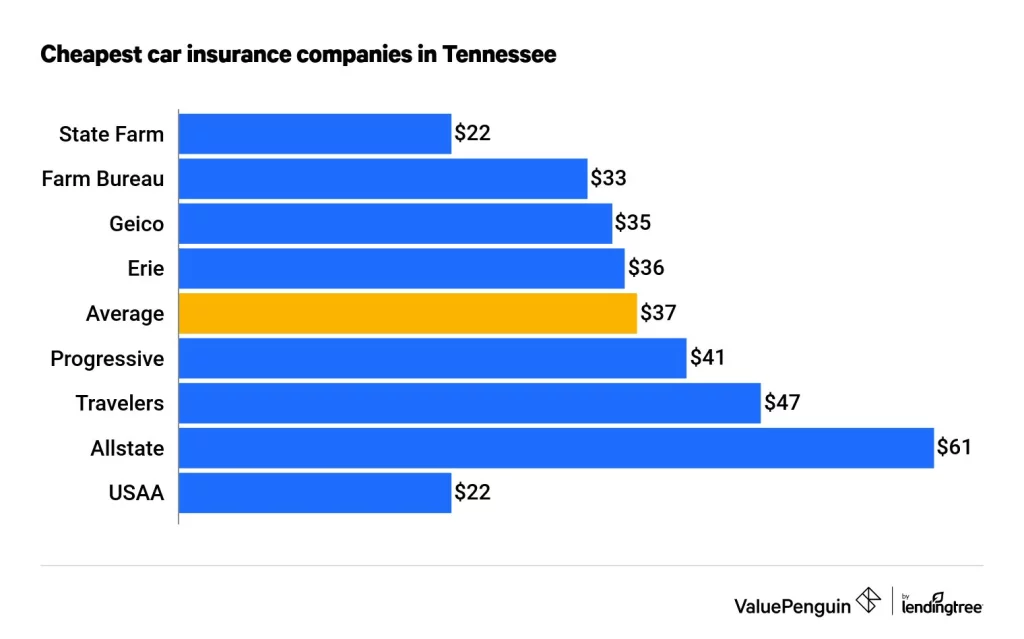

Car insurance rates in Tennessee can vary based on several factors, including your age, driving history, location, type of vehicle, and the coverage options you choose.

It’s advisable to shop around and compare quotes from multiple insurance companies to find the best coverage at the most competitive rate.

Remember that the information provided here is a general overview of car insurance in Tennessee.

Insurance requirements and regulations may change, so it’s essential to consult with an insurance agent or company for the most up-to-date and accurate information tailored to your specific situation.

Average Cost of Car Insurance in Tennessee

The average cost of car insurance in Tennessee can vary depending on various factors, including your age, driving history, location, type of vehicle, coverage options, and the insurance company you choose. However, to provide a general idea, let’s consider some average figures.

According to recent data, the average annual premium for car insurance in Tennessee is around $1,375. This figure is based on a profile of a 30-year-old driver with a clean driving record, insuring a 2018 Honda Accord and carrying the state’s minimum liability coverage.

It’s important to note that your actual premium may be higher or lower than the average depending on your individual circumstances. Factors such as your age, driving history, credit score, coverage limits, and deductible will influence the cost of your car insurance.

Additionally, if you choose to add optional coverages or increase your liability limits beyond the state minimum requirements, your premium will increase accordingly. Factors such as living in a densely populated area or an area with higher accident rates may also impact your premium.

To get a more accurate estimate of car insurance costs for your specific situation, it’s advisable to contact insurance providers directly and request quotes based on your personal details. Shopping around and comparing quotes from multiple insurers will help you find the best coverage at a competitive rate.

Best Car Insurance in Tennessee

Determining the “best” car insurance provider in Tennessee can be subjective, as it depends on individual needs and preferences.

However, several well-known insurance companies consistently receive positive reviews and have a strong presence in Tennessee. Here are some insurance providers that are often recognized for their quality service and competitive offerings:

State Farm:

State Farm is one of the largest car insurance companies in the United States and has a significant presence in Tennessee. They offer a wide range of coverage options, and discounts, and have a reputation for excellent customer service.

GEICO:

GEICO is known for its competitive rates and user-friendly online tools. They have a strong presence in Tennessee and provide various coverage options, discounts, and a straightforward claims process.

Progressive:

Progressive is another popular car insurance company known for its innovative policies and competitive rates. They offer a range of coverage options, including usage-based insurance, and have a user-friendly online platform.

Allstate:

Allstate is well-established in the insurance industry and provides a variety of coverage options and discounts. They have local agents across Tennessee who can provide personalized service and guidance.

Farm Bureau Insurance:

Farm Bureau Insurance is a regional insurance provider that offers coverage options specifically tailored to rural areas and agricultural needs. They have a strong presence in Tennessee and are known for their commitment to serving local communities.

It’s important to note that while these companies are often recognized for their quality service, the “best” insurance provider for you will depend on your specific needs, budget, and preferences.

It’s recommended to obtain quotes from multiple insurance companies, compare coverage options, rates, and customer reviews to make an informed decision.

Additionally, consider reaching out to friends, family, or local agents for recommendations based on their personal experiences.