Car insurance in Oregon provides financial protection in case of accidents, theft, or damage to your vehicle. It helps cover the costs of repairs, medical expenses, and legal fees if you’re involved in a collision. Without insurance, you may have to bear these costs out of pocket, which can be financially burdensome.

In many jurisdictions, including most U.S. states, having car insurance is a legal requirement. Driving without insurance can lead to fines, license suspension, or even legal consequences. Car insurance ensures you comply with the law and provides proof of financial responsibility in case of accidents.

Car insurance typically includes liability coverage, which helps protect you from financial responsibility if you’re at fault in an accident. It covers the costs of injuries or property damage to others involved in the collision. This coverage is essential as it helps safeguard your assets and future earnings in case of a lawsuit.

Car insurance often includes medical payments coverage or personal injury protection (PIP). These coverages help pay for medical expenses for you and your passengers, regardless of fault. They can cover costs such as hospital bills, medical treatments, rehabilitation, and even lost wages due to injuries.

Car insurance may include coverage for uninsured or underinsured motorists. This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps ensure you’re not left financially vulnerable in such situations.

Having car insurance provides peace of mind while driving. Accidents can happen unexpectedly, and knowing you have insurance coverage can alleviate the stress and worry associated with potential financial liabilities. It allows you to focus on driving safely and enjoying your time on the road.

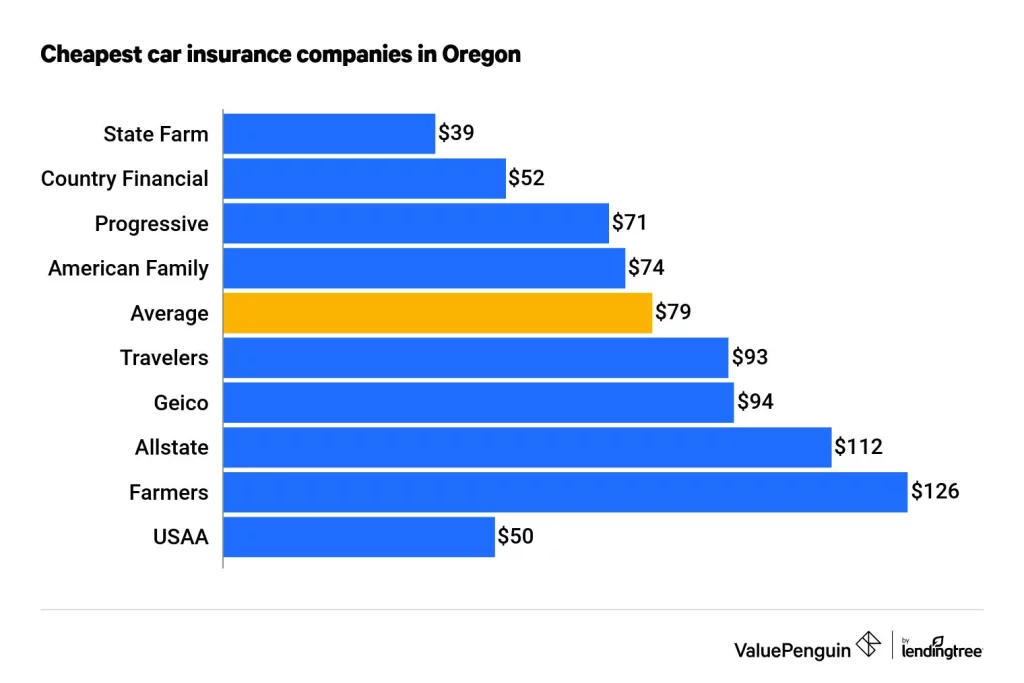

Average cost of Car Insurance in Oregon

The average cost of car insurance in Oregon can vary depending on various factors such as your age, driving record, location, type of vehicle, coverage limits, and deductibles. However, to provide you with a general idea, I can share some average premium figures.

According to the National Association of Insurance Commissioners (NAIC)In Oregon, the average cost of car insurance is $1,181 per year. Drivers with a minimum coverage policy only pay about $802 per year. It’s important to note that this is just an average, and your actual premium could be higher or lower based on your specific circumstances.

The minimum liability coverage limits in Oregon are as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $20,000 property damage liability coverage per accident

Keep in mind that these are minimum requirements, and it’s often recommended to consider higher coverage limits to adequately protect yourself and your assets.

To get an accurate estimate of car insurance costs tailored to your situation, it’s best to reach out to insurance providers and request quotes based on your specific details. Insurance companies consider various factors when calculating premiums, so obtaining multiple quotes will help you compare prices and find the best coverage at a competitive rate.

Best Car Insurance Companies in Oregon

There are several reputable car insurance companies operating in Oregon. While the “best” company can vary based on individual needs and preferences, here are some of the well-regarded car insurance providers in Oregon:

State Farm:

State Farm is one of the largest car insurance companies in the country and is known for its extensive coverage options, competitive rates, and excellent customer service. They have a strong presence in Oregon and offer various discounts to policyholders.

Geico:

Geico is known for its affordable rates and user-friendly online platform. They provide a wide range of coverage options and discounts, making them a popular choice among many Oregon drivers.

Progressive:

Progressive is recognized for its innovative insurance offerings, including usage-based insurance programs like Snapshot. They offer competitive rates and provide a range of coverage options and discounts to policyholders.

Farmers Insurance:

Farmers Insurance is well-established in Oregon and offers comprehensive coverage options for car insurance. They have a network of agents throughout the state who provide personalized service to policyholders.

Allstate:

Allstate is a reputable insurance company known for its extensive coverage options and excellent customer support. They offer a variety of discounts and have a strong presence in Oregon.

American Family Insurance:

American Family Insurance, also known as AmFam, provides auto insurance coverage tailored to individual needs. They offer competitive rates, discounts, and options for personalized coverage.

Liberty Mutual:

Liberty Mutual is known for its customizable policies and numerous coverage options. They offer various discounts, including multi-policy and safe driver discounts, to help policyholders save on premiums.

USAA:

USAA is a highly regarded insurance provider that caters to military members, veterans, and their families. They are known for their exceptional customer service and comprehensive coverage options.

Travelers:

Travelers Insurance offers a range of coverage options and discounts for Oregon drivers. They provide personalized service and have a strong financial standing.

Nationwide:

Nationwide is a well-established insurance company that offers a variety of coverage options and discounts. They have a network of agents in Oregon and provide personalized support to policyholders.

When choosing a car insurance company, it’s important to consider factors such as coverage options, customer service, financial stability, and pricing. Comparing quotes and researching customer reviews can help you make an informed decision based on your specific needs and preferences.