In Nevada, car insurance is mandatory for all drivers. If you own a vehicle and drive it on public roads, you must carry the minimum required car insurance coverage as mandated by the state.

The minimum liability insurance requirements for Nevada are as follows:

- $25,000 bodily injury liability coverage per person: This covers the medical expenses and other costs associated with injuries to a single individual in an accident you cause.

- $50,000 bodily injury liability coverage per accident: This covers the total medical expenses and other costs associated with injuries to multiple individuals in an accident you cause.

- $20,000 property damage liability coverage per accident: This covers the repairs or replacement costs for damages caused to someone else’s property in an accident you cause.

These are the minimum requirements, but you can opt for higher coverage limits and additional types of coverage to provide more protection for yourself and your vehicle.

Additionally, Nevada operates under a tort system, which means that the at-fault driver is responsible for paying for the damages resulting from an accident. It’s crucial to have adequate insurance coverage to protect yourself financially in case of an accident.

When shopping for car insurance in Nevada, it’s a good idea to compare quotes from different insurance providers to find the best coverage options and rates that suit your needs. Be sure to inquire about any available discounts, such as safe driver discounts or multi-policy discounts, that may help reduce your premiums.

Average Cost of Car Insurance in Nevada

The average cost of car insurance in Nevada can vary depending on several factors, including your age, driving record, location, the type of car you drive, and the coverage limits you choose. However, I can provide you with some general information on the average cost of car insurance in Nevada.

According to data from the National Association of Insurance Commissioners (NAIC), the average annual premium for auto insurance in Nevada in 2023 (the latest available data) is between $973 and $2,779. Please note that this is an average, and individual premium can be higher or lower based on the factors mentioned earlier.

It’s important to remember that car insurance rates can change over time due to various factors, including insurance company trends, economic conditions, and changes in your circumstances. Additionally, insurance companies use their unique algorithms and criteria to determine premiums, so it’s advisable to obtain quotes from multiple insurance providers to compare rates and find the best coverage at a competitive price.

To get a more accurate estimate of car insurance costs for your specific situation, I recommend contacting insurance companies directly or using online insurance comparison tools that allow you to input your details and receive personalized quotes.

Benefits of car Insurance in Nevada

Car insurance in Nevada provides several benefits that help protect you financially in the event of an accident or other covered incidents. Here are some of the key benefits of having car insurance in Nevada:

Liability Coverage:

Car insurance provides liability coverage, which is required by law in Nevada. This coverage helps protect you if you are at fault in an accident and are responsible for causing bodily injury or property damage to others. It covers the medical expenses, rehabilitation costs, and property repair or replacement costs for the other party involved.

Personal Injury Protection (PIP):

Nevada is a no-fault insurance state, meaning that regardless of who is at fault, your own insurance will cover your medical expenses and related costs in case of an accident. Personal Injury Protection (PIP) coverage helps pay for your medical bills, lost wages, and other related expenses resulting from injuries sustained in an accident.

Uninsured/Underinsured Motorist Coverage:

This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. It helps pay for your medical expenses and property damage when the at-fault party is uninsured or underinsured.

Property Damage Coverage:

Car insurance also provides coverage for damage to your vehicle or other property caused by covered incidents such as accidents, vandalism, or theft. This coverage helps pay for the repair or replacement of your vehicle, minimizing your out-of-pocket expenses.

Peace of Mind:

Car insurance provides peace of mind knowing that you are financially protected against unexpected accidents, damages, or injuries. It allows you to drive with confidence, knowing that you have coverage in place to handle any potential liabilities.

Best Car Insurance Firms in Nevada

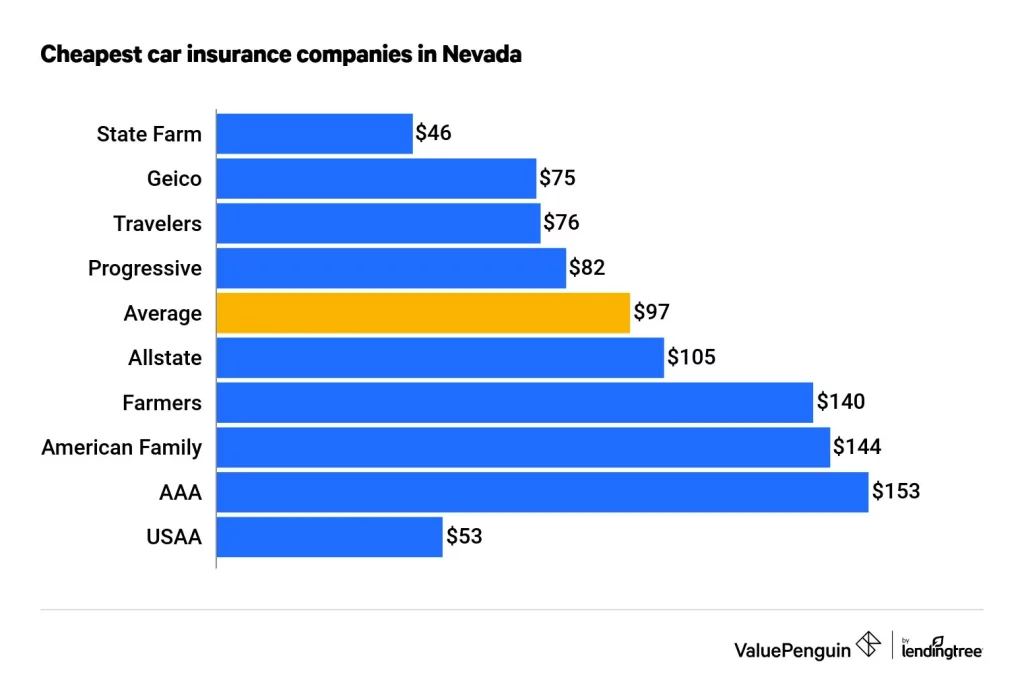

There are several reputable car insurance companies that operate in Nevada. The “best” car insurance firm for you will depend on your specific needs, budget, and preferences. However, here are some well-known insurance companies that consistently receive positive reviews and have a strong presence in Nevada:

State Farm:

State Farm is one of the largest insurance providers in the United States, known for its extensive coverage options and competitive rates. They offer a wide range of auto insurance coverage options and have a strong presence in Nevada with numerous agents throughout the state.

Geico:

Geico is known for its affordable rates and user-friendly online platform. They provide a variety of coverage options, discounts, and 24/7 customer support. Geico is often praised for its efficient claims process and competitive pricing.

Progressive:

Progressive is another popular choice among Nevada drivers. They offer a range of coverage options, including liability, comprehensive, collision, and more. Progressive is well-regarded for its user-friendly website, competitive rates, and various discounts.

Allstate:

Allstate is a well-established insurance company that offers comprehensive coverage options and excellent customer service. They provide various discounts and optional coverage add-ons to tailor policies to individual needs.

USAA:

If you’re an active or retired member of the military or a family member, USAA is worth considering. USAA consistently receives high customer satisfaction ratings and offers competitive rates and comprehensive coverage options specifically tailored to the needs of military personnel and their families.

It’s essential to compare quotes, coverage options, and customer reviews from multiple insurance companies to find the one that best fits your requirements. Additionally, consider factors such as financial stability, customer service, and claims satisfaction when making your decision.