Car insurance in Michigan is unique compared to other states in the United States due to its no-fault insurance system. Here are some key points about car insurance in Michigan:

No-Fault Insurance:

Michigan follows a no-fault car insurance system, which means that regardless of who is at fault in an accident, each party’s insurance company is responsible for covering their own policyholder’s medical expenses and damages. This system is designed to provide prompt medical treatment and reduce the need for litigation.

Personal Injury Protection (PIP):

Michigan requires all drivers to carry Personal Injury Protection coverage, commonly known as PIP. PIP covers medical expenses, rehabilitation costs, lost wages, and other related expenses resulting from an auto accident, regardless of fault. Michigan is unique in that it provides unlimited PIP benefits, meaning there is no cap on medical coverage.

Property Protection Insurance (PPI):

Michigan also requires drivers to carry Property Protection Insurance (PPI), which covers up to $1 million for property damage caused by your vehicle in other states. This coverage is intended to compensate for damage to buildings, fences, and other structures.

Required Minimum Coverage:

In addition to PIP and PPI, Michigan drivers are required to carry liability insurance to cover bodily injury and property damage caused to others. The minimum liability coverage limits in Michigan are:

$50,000 per person for bodily injury or death

$100,000 per accident for bodily injury or death

$10,000 per accident for property damage

High Insurance Costs: Car insurance in Michigan tends to be more expensive compared to other states. This is primarily due to the unlimited PIP benefits and the high number of uninsured drivers in the state.

Insurance Fraud Fee:

Michigan has a unique fee called the Insurance Fraud Fee, which is added to car insurance policies. This fee helps fund efforts to combat insurance fraud within the state.

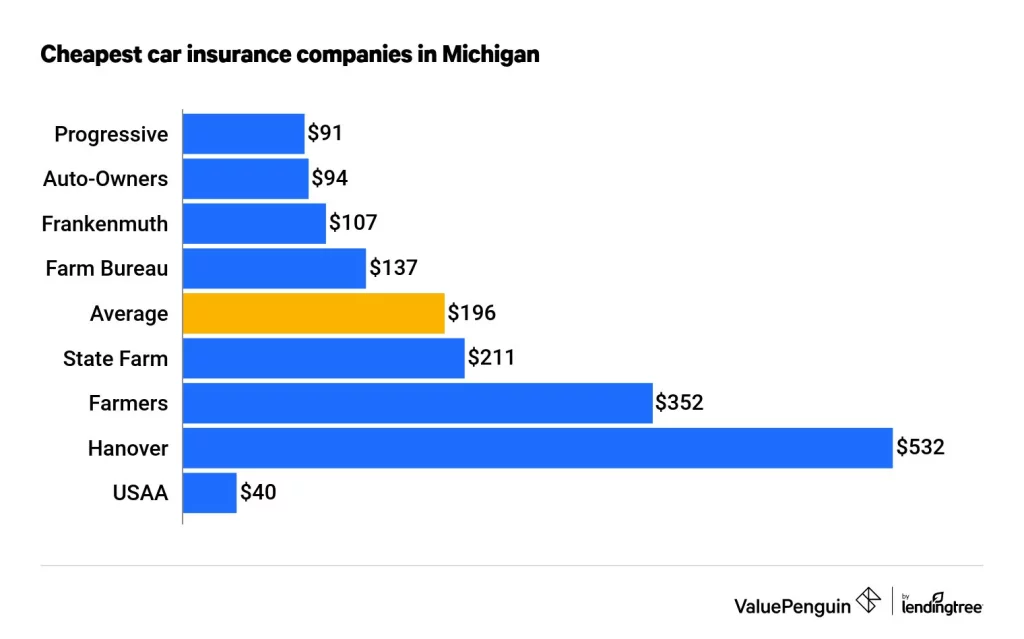

Average Car Insurance in Michigan

Keep in mind that car insurance rates can vary significantly based on several factors, including your age, driving history, location, type of vehicle, and the insurance company you choose. It’s always best to obtain personalized quotes from insurance providers to get an accurate estimate of the cost.

According to a 2023 study by MoneyGeek, the average annual car insurance premium in Michigan is $4,333 per year or $361 per month. It’s important to note that these figures are averages, and individual rates can be higher or lower depending on the factors mentioned above.

Best Car Insurance Companies in Michigan

There are several car insurance companies that operate in Michigan, and the “best” company for you will depend on your specific needs and preferences. However, I can provide you with a list of some well-known and reputable car insurance companies in Michigan:

Auto-Owners Insurance:

Auto-Owners Insurance is a highly regarded insurance company that consistently receives positive reviews for its customer service and claims handling. They offer a wide range of coverage options and have a strong presence in Michigan.

State Farm:

State Farm is one of the largest car insurance providers in the United States and has a strong presence in Michigan. They offer a variety of coverage options and have a reputation for good customer service.

Progressive:

Progressive is known for its competitive rates and user-friendly online tools. They offer a range of coverage options and have a strong presence in Michigan.

Allstate:

Allstate is a well-known insurance company that offers various coverage options and has a strong network of agents in Michigan. They provide personalized policies and offer a range of discounts.

Farm Bureau Insurance of Michigan:

Farm Bureau Insurance is a Michigan-based company that specializes in providing insurance to residents of rural areas. They are known for their personalized service and competitive rates.

GEICO:

GEICO is a popular insurance company that offers competitive rates and a variety of coverage options. They have a strong online presence and provide 24/7 customer service.

These are just a few examples, and there are other insurance companies available in Michigan as well. It’s a good idea to obtain quotes from multiple providers, compare coverage options, and consider customer reviews to find the best car insurance company that suits your needs.

It’s important to note that car insurance rates can vary significantly based on several factors, such as your driving record, the type of vehicle you drive, your location, and the insurance company you choose. To get the most accurate and up-to-date information about car insurance rates and coverage in Michigan, it’s advisable to contact insurance providers directly or use online comparison tools to obtain quotes.