In Massachusetts, car insurance is mandatory for all registered vehicle owners and drivers. The state has specific requirements and regulations regarding car insurance coverage. Here are some key points to know about car insurance in Massachusetts:

Minimum Liability Coverage:

- Massachusetts requires drivers to carry a minimum amount of liability insurance coverage, which includes:

- Bodily Injury to Others: Coverage of at least $20,000 per person and $40,000 per accident for bodily injury to others.

- Personal Injury Protection (PIP): At least $8,000 per person, per accident for medical expenses, lost wages, and other related costs resulting from an accident, regardless of who is at fault.

- Property Damage: Coverage of at least $5,000 for property damage caused by the policyholder’s vehicle.

Optional Coverage:

While the above liability coverage is mandatory, Massachusetts drivers have the option to purchase additional coverage, including collision, comprehensive, uninsured/underinsured motorist, and medical payment coverage.

These additional coverages provide further protection and help cover expenses related to vehicle damage, theft, and injuries.

No-Fault System:

Massachusetts follows a “no-fault” car insurance system, meaning that regardless of who is at fault in an accident, each party’s insurance company is responsible for covering their policyholder’s medical expenses and other costs, up to the policy limits.

However, if the accident causes severe injuries or damages exceeding certain thresholds, the at-fault driver may be held responsible for additional compensation.

Proof of Insurance:

Massachusetts law requires drivers to carry proof of insurance with them while driving. The insurance card provided by your insurer serves as proof of coverage.

Penalties for Non-Compliance:

Failing to maintain car insurance in Massachusetts can result in penalties, such as fines, suspension of your driver’s license, and vehicle registration revocation.

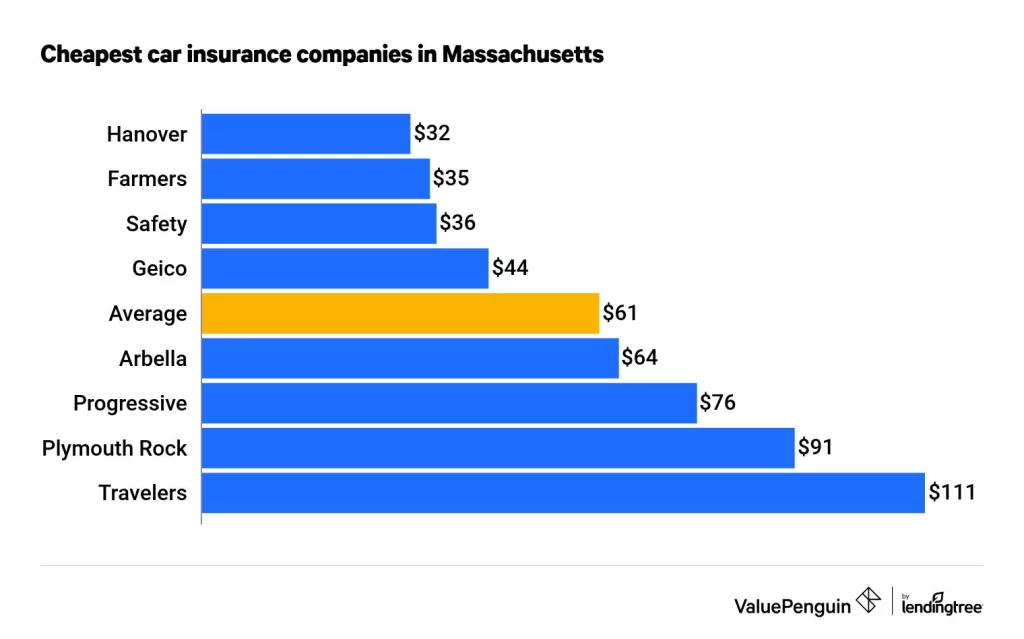

Average Cost of Car Insurance in Massachusetts

The average cost of car insurance in Massachusetts can vary depending on various factors, including your age, driving history, type of vehicle, location, and the coverage options you choose.

However, I can provide you with some general information on average car insurance premiums in Massachusetts.

According to data from the National Association of Insurance Commissioners (NAIC), the average annual car insurance premium in Massachusetts in 2018 (the latest available data) was around $1,264.

Please note that this is an average, and individual premium can be significantly higher or lower based on the factors mentioned earlier.

It’s important to remember that car insurance rates are determined by insurance companies based on risk assessment, and each insurer may have its own formula for calculating premiums.

Additionally, insurance rates can change over time due to factors such as changes in driving records, market conditions, and insurance company policies.

Best Car Insurance Companies in Massachusetts

There are several reputable car insurance companies that operate in Massachusetts. While the “best” car insurance company can vary depending on individual needs and preferences, here are some well-regarded insurance providers in Massachusetts:

GEICO:

GEICO is known for its competitive rates and wide range of coverage options. They often offer affordable premiums and have a user-friendly online platform for policy management.

Progressive:

Progressive is recognized for its extensive coverage options, including unique features like accident forgiveness and deductible savings bank. They also provide a user-friendly website and mobile app for policy management.

Liberty Mutual:

Liberty Mutual is a well-established insurance company with a strong presence in Massachusetts. They offer a variety of coverage options and discounts, along with convenient features like 24/7 claims support and a mobile app for policy management.

Allstate:

Allstate is another popular insurance provider in Massachusetts, offering a range of coverage options and features. They have a large network of agents and provide various discounts, such as safe driver discounts and multi-policy discounts.

Arbella Insurance:

Arbella is a regional insurance company that operates exclusively in New England, including Massachusetts. They are known for their personalized service and competitive rates, especially for drivers with a clean record.

When shopping for car insurance in Massachusetts, it’s advisable to compare quotes from different insurance providers to find the coverage that suits your needs and budget. You can contact various insurance companies or work with an independent insurance agent to explore your options and ensure you comply with the state’s requirements.