Car insurance in Maine, like in most other states, is a legal requirement for drivers. It serves to provide financial protection in case of accidents, damage, or injuries resulting from driving. The primary purpose of car insurance is to cover the costs associated with accidents and to ensure that individuals are financially responsible if they cause harm to others while operating a vehicle.

Car Insurance in Maine

Here are some key points about car insurance in Maine:

Liability Coverage:

Maine, like many states, requires drivers to have liability insurance. This coverage helps pay for injuries or damages you might cause to others in an accident. It typically includes two components: bodily injury liability (for medical expenses, lost wages, and legal fees) and property damage liability (for repairs to other people’s property).

Uninsured/Underinsured Motorist Coverage:

This type of coverage helps you if you’re in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Personal Injury Protection (PIP):

Maine is a “no-fault” state, meaning that regardless of who is at fault, each driver’s insurance pays for their medical expenses and certain other expenses (like lost wages). PIP is the coverage that helps with these costs.

Collision Coverage:

This covers repairs to your vehicle in case of a collision, regardless of fault. It often comes with a deductible, which is the amount you pay out of pocket before the insurance kicks in.

Comprehensive Coverage:

This covers damage to your vehicle from non-collision incidents such as theft, vandalism, fire, or natural disasters.

Minimum Coverage Requirements:

Maine has specific minimum coverage requirements that drivers must meet. These requirements vary depending on the type of coverage and the total amount of coverage.

Proof of Insurance:

Maine law requires drivers to carry proof of insurance at all times while operating a vehicle. This can be a physical copy of the insurance card or an electronic version on a mobile device.

Penalties for Non-Compliance:

Failing to have proper insurance coverage in Maine can result in fines, suspension of your driver’s license, and other legal consequences.

Comparative Negligence:

Maine follows a modified comparative negligence rule. This means that if you’re found partially at fault for an accident, your ability to recover damages might be reduced. If you’re found to be more than 50% at fault, you might not be able to recover damages at all.

Average rates of Car Insurance in Maine

Please note that actual rates can vary widely based on factors such as your age, driving history, the type of coverage you choose, the make and model of your vehicle, and even your location within the state. Insurance rates can also change over time due to various factors.

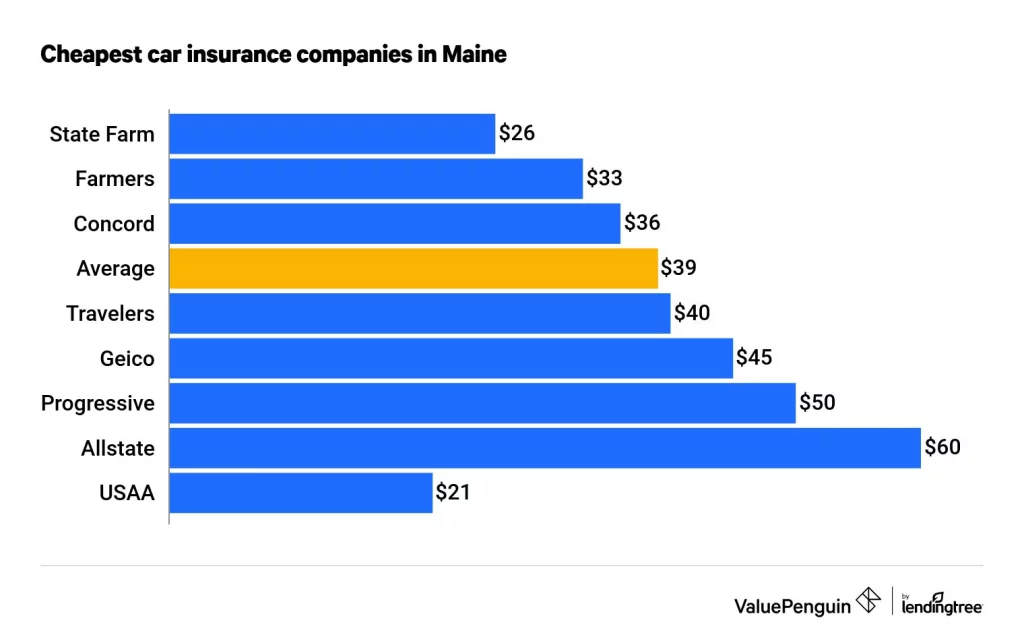

The average cost of car insurance in Maine is $714 per year. This lower average was due in part to Maine’s rural nature and relatively lower population density, which could result in fewer accidents and claims.

It’s important to keep in mind that these figures are rough estimates and the actual rates you receive could be higher or lower based on your personal circumstances and the insurance company you choose. The best way to get an accurate estimate of car insurance rates in Maine is to request quotes from multiple insurance providers, taking into consideration your specific details.

Since insurance rates can change over time and vary from person to person, I recommend reaching out to insurance companies directly or using online insurance comparison tools to get the most current and personalized rate estimates for your situation.

Best Car Insurance Companies in Maine

Keep in mind that the “best” car insurance company can vary depending on individual preferences, driving history, coverage needs, and budget. Here are some insurance companies that were often considered reputable options in Maine:

State Farm: State Farm is known for its extensive agent network and a wide range of coverage options. Their personalized approach and various discounts could make them a good choice for many drivers.

GEICO: GEICO is known for competitive rates and a straightforward online quote process. They offer a variety of discounts and have a user-friendly website and mobile app.

Progressive: Progressive is often praised for its innovative approach to insurance, including tools like their Snapshot program that monitors driving habits for potential discounts. They also offer a range of coverage options.

Allstate: Allstate offers a variety of coverage options and discounts. Their Drivewise program is similar to Snapshot and provides the opportunity for safe drivers to save on premiums.

USAA: If you are eligible (typically for military members and their families), USAA is highly regarded for its excellent customer service and competitive rates. They consistently receive high marks in customer satisfaction surveys.

AAA (Northern New England): AAA offers not only roadside assistance but also various insurance options, and their local presence can be beneficial for Maine residents.

Liberty Mutual: Liberty Mutual is known for its customization options and discounts, as well as its breadth of coverage choices.

MMG Insurance: This company is based in Maine and has a strong presence in the state. Local presence might offer some advantages for personalized service.

When looking for the best car insurance company in Maine, consider factors such as coverage options, customer service reputation, discounts offered, ease of claims process, and, of course, the cost of premiums.

It’s important to note that the specifics of car insurance coverage and regulations can change, so it’s recommended to consult the most up-to-date information from your local Department of Motor Vehicles or an insurance professional when seeking insurance in Maine. Additionally, the best coverage for you will depend on your circumstances, driving habits, and budget.