Car insurance is a type of policy that provides financial protection against damage to your vehicle, injuries to yourself or others, and any liability that may arise from an accident. It is mandatory in most countries to have car insurance if you own a vehicle, and there are several reasons why it is important to have it.

Firstly, car insurance provides financial protection against unforeseen circumstances, such as accidents, theft, fire, or natural disasters. In the event of an accident, the insurance company will cover the cost of repairing or replacing your vehicle, as well as any medical expenses that may arise from injuries sustained by you or others involved in the accident.

Secondly, car insurance protects you from liability. If you are found to be at fault for an accident, you may be liable for the damages caused to the other party involved in the accident. Car insurance will cover these costs, which can be substantial.

Lastly, car insurance is mandatory in most countries. Failure to have car insurance can result in fines, penalties, or even the suspension of your driver’s license. Additionally, if you are involved in an accident without insurance, you may be personally responsible for paying for any damages or medical expenses, which can be financially devastating.

In conclusion, car insurance is a must-have for anyone who owns a vehicle. It provides financial protection against unforeseen circumstances, protects you from liability, and is mandatory in most countries. It is important to carefully consider your options and choose the right policy that fits your needs and budget.

How to Claim Car Insurance After an Accident

If you’ve been involved in a car accident and have car insurance, there are a few steps you can take to file an insurance claim:

- Exchange Information: First, exchange information with the other driver(s) involved in the accident, including names, contact details, and insurance information.

- Document the Accident Scene: If possible, take photos of the accident scene, including any damage to your car, the other car(s) involved, and any injuries sustained.

- Contact Your Insurance Company: Contact your insurance company as soon as possible to report the accident and file a claim. Be prepared to provide details about the accident, including the date, time, and location, as well as any other relevant information.

- Provide Documentation: Your insurance company may ask for documentation related to the accident, such as a police report or medical records. Be sure to provide any requested information in a timely manner.

- Get Your Car Repaired: Once your claim has been approved, you can take your car to a repair shop to get it fixed. Your insurance company may have preferred repair shops that they work with, but you can choose your own if you prefer.

- Pay Your Deductible: Depending on the terms of your insurance policy, you may be responsible for paying a deductible before your insurance company covers the rest of the cost of repairs.

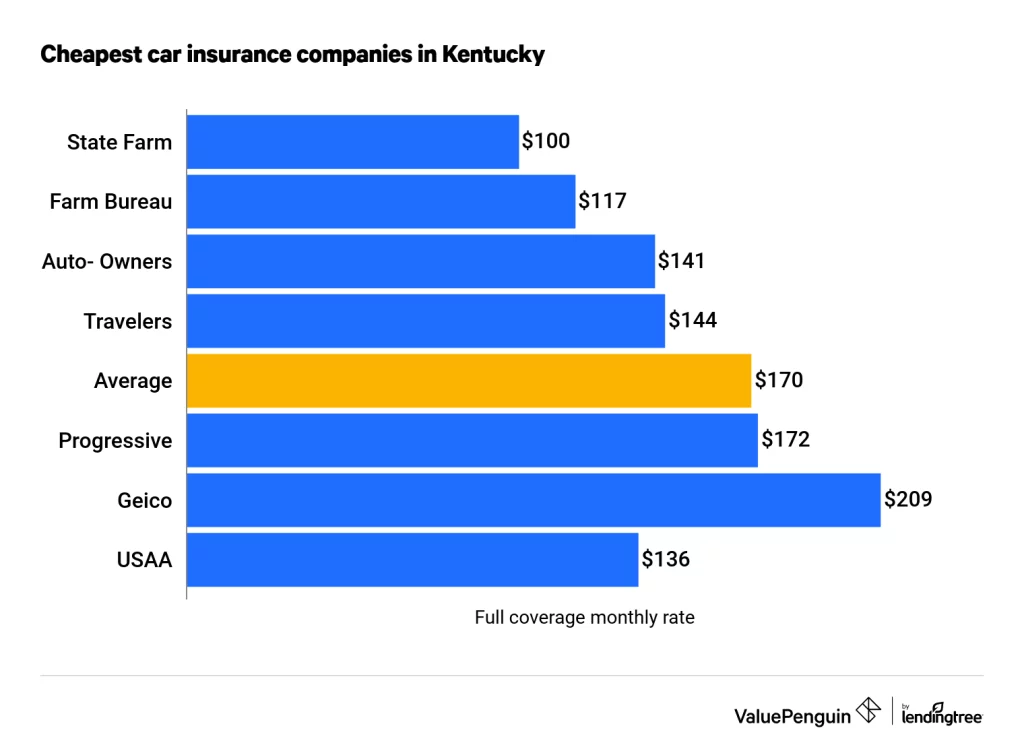

Average cost of Car Insurance in Kentucky

The cost of car insurance in Kentucky can vary depending on a variety of factors, including your age, driving history, the type of car you drive, and the level of coverage you need. That being said, the average cost of car insurance in Kentucky is approximately $1,220 per year for a minimum coverage policy and $2,990 per year for a full coverage policy.

It’s important to note that these are only average costs and your actual cost of car insurance may be higher or lower depending on your individual circumstances. Additionally, there are several factors that can impact your car insurance rates, such as your credit score, where you live, and how much you drive.

To get an accurate estimate of the cost of car insurance for your specific situation, it’s best to shop around and compare quotes from multiple insurance companies. This can help you find the best coverage at the most affordable price.

Best Car Insurance Companies in Kentucky

There are several car insurance companies operating in Kentucky, and the best one for you will depend on your individual needs and preferences. That being said, here are some of the top car insurance companies in Kentucky based on their customer satisfaction ratings, financial strength, and coverage options:

State Farm:

State Farm is one of the largest car insurance companies in the US and has a strong presence in Kentucky. They offer a wide range of coverage options, including liability, collision, and comprehensive coverage.

Geico:

Geico is known for their affordable rates and excellent customer service. They offer a variety of discounts, such as safe driving and multi-car discounts, to help customers save money on their car insurance premiums.

Allstate:

Allstate is another popular car insurance company in Kentucky. They offer a variety of coverage options, including liability, collision, and comprehensive coverage, as well as roadside assistance and rental car coverage.

Nationwide:

Nationwide is a well-known car insurance company that offers a variety of coverage options, including liability, collision, and comprehensive coverage. They also offer a variety of discounts, such as safe driving and multi-policy discounts, to help customers save money on their car insurance premiums.

Progressive:

Progressive is known for its innovative approach to car insurance, such as its usage-based insurance program, Snapshot. They offer a variety of coverage options, including liability, collision, and comprehensive coverage, as well as roadside assistance and rental car coverage.

When choosing a car insurance company in Kentucky, it’s important to compare quotes from multiple companies to ensure that you’re getting the best coverage at the most affordable price.

It’s important to remember that the process of filing a claim can vary depending on the specifics of your insurance policy and the circumstances of the accident. Be sure to carefully review your policy and follow any specific instructions provided by your insurance company.