In Indiana, it is mandatory to have car insurance if you are driving on the roads. The minimum requirements for car insurance in Indiana include:

- Liability coverage: This covers the damages you cause to other people’s property or injuries you cause to other people in an accident. The minimum limits for liability coverage in Indiana are 25/50/10. This means that you must have coverage of at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage per accident.

- Uninsured/Underinsured motorist coverage: This covers the damages you sustain in an accident caused by a driver who does not have enough or any insurance. The minimum limits for uninsured/underinsured motorist coverage in Indiana are 25/50.

- Medical payments coverage: This covers the medical expenses you and your passengers incur in an accident, regardless of who is at fault. The minimum limit for medical payments coverage in Indiana is $4,500.

It is important to note that these are only the minimum requirements for car insurance in Indiana.

You may want to consider additional coverage options, such as collision and comprehensive coverage, which can help cover damages to your own vehicle in an accident or other incidents such as theft, vandalism, or weather-related damage.

To find the best car insurance coverage and rates in Indiana, it is recommended that you shop around and compare quotes from different insurance providers.

You can also consult with an insurance agent who can help you understand your coverage options and find a policy that meets your specific needs and budget.

Types of Car Insurance

There are several types of car insurance coverage options that you can choose from. The most common types of car insurance are:

Collision coverage:

This covers the damages to your car if you collide with another vehicle or object, regardless of who is at fault.

Comprehensive coverage:

This covers damages to your car caused by non-collision incidents such as theft, vandalism, fire, natural disasters, or hitting an animal.

Personal injury protection (PIP) coverage:

This covers medical expenses, lost wages, and other related expenses for you and your passengers in case of an accident, regardless of who is at fault.

Uninsured/Underinsured motorist coverage:

This covers damages or injuries caused by a driver who is not insured or does not have enough insurance to cover the damages.

Gap insurance:

This covers the difference between the amount you owe on your car loan or lease and the actual cash value of your car, in case your car is totaled in an accident or stolen.

Roadside assistance coverage:

This provides help in case of a roadside emergency, such as a flat tire, dead battery, or lockout.

It’s important to note that the types and amount of car insurance coverage you need may vary based on your state laws, the value of your car, your driving history, and your personal preferences. It’s always a good idea to consult with an insurance agent to help you understand your options and choose the best coverage for your needs and budget.

Average Cost of Car Insurance in Indiana

The average cost of car insurance in Indiana varies based on several factors, such as your age, driving record, location, type of car, and the level of coverage you choose. According to recent data from the National Association of Insurance Commissioners (NAIC), the average annual car insurance premium in Indiana is around $684 for minimum liability coverage and $1,512 for full coverage.

However, these are just average rates and your actual car insurance premiums may be higher or lower based on your individual circumstances. For example, if you have a clean driving record, you may be eligible for discounts on your car insurance premiums. On the other hand, if you have a history of accidents or traffic violations, your premiums may be higher.

Additionally, the type of car you drive can also affect your car insurance premiums. Generally, cars with higher safety ratings and lower repair costs tend to have lower insurance premiums compared to high-performance or luxury vehicles.

To find the best car insurance rates in Indiana, it’s a good idea to shop around and compare quotes from different insurance providers. You can also consult with an insurance agent who can help you find a policy that meets your needs and budget.

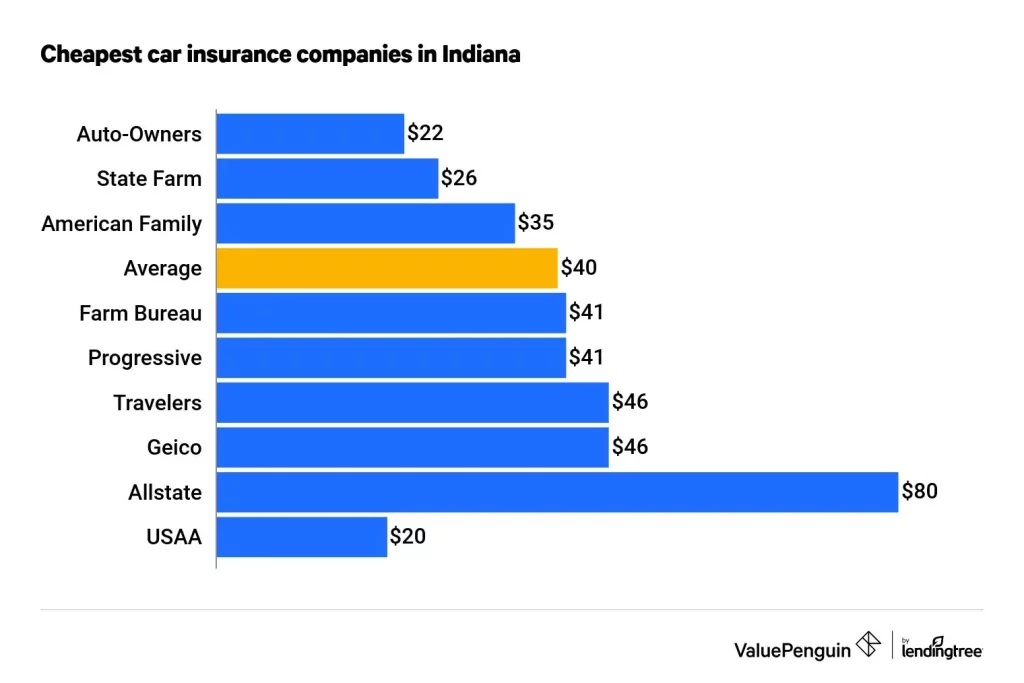

Best Car Insurance Companies in Indiana

There are several car insurance companies that offer coverage in Indiana. The best car insurance companies in Indiana may vary depending on your individual needs and preferences. Here are some of the top car insurance companies in Indiana based on customer satisfaction, financial strength, and overall reputation:

USAA:

USAA is known for its excellent customer service and affordable rates. However, it is only available to current and former members of the military and their families.

State Farm:

State Farm is one of the largest car insurance providers in the country and is known for its competitive rates and comprehensive coverage options.

Geico:

Geico is a popular choice for car insurance in Indiana, offering affordable rates and a user-friendly online platform.

Farmers Insurance:

Farmers Insurance provides a wide range of coverage options and discounts for good drivers, students, and homeowners.

Allstate:

Allstate offers a variety of coverage options and discounts, including safe driver discounts and multi-policy discounts.

Progressive:

Progressive is known for its competitive rates and unique discounts, such as discounts for signing up online and for using its Snapshot program.

Liberty Mutual:

Liberty Mutual offers a variety of coverage options, including accident forgiveness and new car replacement coverage.

It’s important to shop around and compare quotes from multiple insurance providers to find the best car insurance coverage and rates for your individual needs and budget. You can also consult with an insurance agent who can help you understand your options and find the right coverage for you.