Car insurance in Florida is required by law for all registered vehicles. The state follows a no-fault insurance system, which means that your insurance company will pay for your medical expenses and certain other damages regardless of who was at fault in an accident. Here are some key points to know about car insurance in Florida:

- Minimum Coverage Requirements: Florida law requires drivers to have a minimum amount of insurance coverage, including:

- Personal Injury Protection (PIP) coverage of at least $10,000 per person, per accident.

- Property Damage Liability (PDL) coverage of at least $10,000 per accident.

- Optional Coverages: While the above coverages are mandatory, you may also choose to purchase additional optional coverages, such as:

- Bodily Injury Liability (BIL) coverage, provides financial protection if you injure someone in an accident.

- Collision coverage, which pays for damages to your vehicle in case of a collision.

- Comprehensive coverage covers non-collision-related damages like theft, vandalism, or weather events.

- Uninsured/Underinsured Motorist Coverage: Florida does not require drivers to carry uninsured/underinsured motorist coverage, but it is highly recommended. This coverage protects you if you’re involved in an accident with a driver who has little or no insurance.

- High-Risk Drivers: If you have a history of accidents, violations, or other factors that make you a high-risk driver, you may need to obtain coverage through the Florida Automobile Joint Underwriting Association (FAJUA) or a licensed insurance company that specializes in insuring high-risk drivers.

- Insurance Verification: Florida has a system called the Florida Financial Responsibility Law, which requires insurance companies to electronically report insurance information to the state. If you are unable to provide proof of insurance during a traffic stop or if your coverage lapses, you may face penalties, including fines and suspension of your driver’s license.

When shopping for car insurance in Florida, it’s a good idea to compare quotes from multiple insurance companies to find the coverage that best suits your needs and budget. Be sure to review the policy terms, coverage limits, deductibles, and any additional benefits or discounts offered by the insurer.

Average Cost Car Insurance in Florida

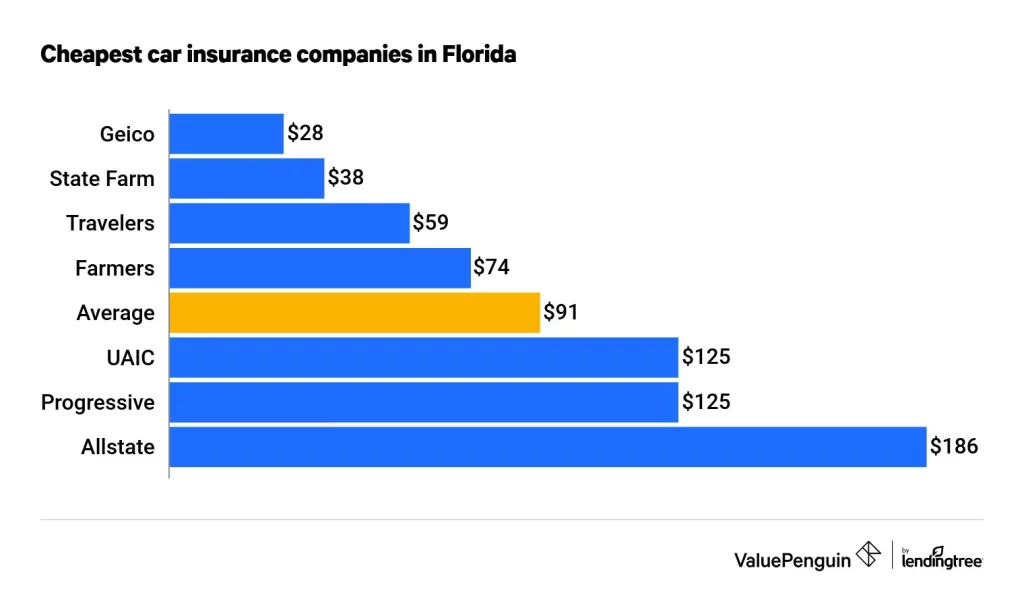

The average cost of car insurance in Florida can vary depending on several factors, including your age, driving history, type of vehicle, coverage limits, and the insurance company you choose. However, to provide you with a general idea, I can provide some average figures.

Florida had one of the highest average car insurance rates in the United States. On average, Floridians paid around $1,128 for minimum coverage and $3,183 for full coverage per year for car insurance. Please note that this is just an estimate, and your actual premium could be higher or lower based on your specific circumstances.

It’s important to remember that car insurance rates are highly personalized, and they can vary significantly from person to person. Factors such as your age, driving record, credit score, location within Florida, and the type of coverage you choose can all influence your premium.

To get an accurate estimate of the cost of car insurance in Florida, it’s best to request quotes from multiple insurance companies. This way, you can compare prices and coverage options to find the most suitable and affordable policy for your needs.

Top 10 Car Insurance Companies in Florida

While I can provide you with a list of some well-known car insurance companies in Florida, it’s important to note that the ranking and preferences can vary based on individual needs and preferences. Here are ten reputable car insurance companies in Florida, along with a brief description and some benefits they offer:

State Farm:

State Farm is one of the largest car insurance providers in Florida, offering a range of coverage options. They have a large network of agents and provide reliable customer service. State Farm also offers various discounts and bundling options for multiple policies.

GEICO:

GEICO is known for its competitive rates and convenient online tools. They offer a straightforward quote process and 24/7 customer service. GEICO provides a range of coverage options and discounts for safe drivers, military personnel, and more.

Allstate:

Allstate is a popular choice in Florida, offering customizable coverage options and additional features like accident forgiveness and new car replacement coverage. They have a network of agents throughout the state and provide various discounts for policyholders.

Progressive:

Progressive is well-known for its innovative Snapshot program, which rewards safe driving habits with potential discounts. They offer a variety of coverage options, including specialized coverage for RVs and motorcycles. Progressive also has a user-friendly website and mobile app for policy management.

USAA:

USAA primarily serves military members and their families, offering competitive rates and exceptional customer service. They provide comprehensive coverage options and benefits tailored to the needs of military personnel, including flexible payment options and deployment discounts.

Liberty Mutual:

Liberty Mutual offers a range of coverage options and additional benefits like accident forgiveness and better car replacement coverage. They have a user-friendly website and mobile app, and policyholders can access 24/7 customer service.

Nationwide:

Nationwide provides various coverage options and discounts for policyholders in Florida. They offer features like accident forgiveness and vanishing deductibles. Nationwide has a large network of agents and provides multiple ways to file claims.

Travelers:

Travelers Insurance offers customizable coverage options and additional benefits like accident forgiveness and roadside assistance. They have a user-friendly website and mobile app, making it convenient for policyholders to manage their coverage and file claims.

Farmers Insurance:

Farmers Insurance provides a range of coverage options and additional features like accident forgiveness and roadside assistance. They offer various discounts, including multi-policy and safe driver discounts. Farmers Insurance also has a network of agents throughout Florida.

Auto-Owners Insurance:

Auto-Owners Insurance is known for its personalized service and comprehensive coverage options. They have a strong financial standing and offer competitive rates. Auto-Owners Insurance provides various discounts and additional benefits like roadside assistance.

It’s important to thoroughly research each company, review their coverage options, and consider customer reviews and ratings before making a decision. Additionally, obtaining quotes from multiple insurers can help you compare prices and find the best car insurance coverage for your specific needs.