Detroit, also known as Motor City, is home to the American automobile industry and has a rich history of car culture. As a result, it’s no surprise that many Detroit residents rely heavily on their cars to get around the city.

However, with the high frequency of car accidents and theft in the city, it is crucial for Detroit drivers to have proper car insurance coverage. Car insurance in Detroit not only protects drivers financially in the event of an accident or theft but is also required by law.

Detroit drivers must carry a minimum amount of liability insurance to operate a vehicle in the city legally. In this context, obtaining adequate car insurance in Detroit is crucial to protect oneself from financial liabilities and potential legal consequences.

How Beneficial a Car Insurance can be in Detroit?

Car insurance can be highly beneficial for drivers in Detroit for various reasons. Firstly, car accidents are relatively common in Detroit due to its high population density and heavy traffic, which increases the risk of collisions. In the event of an accident, car insurance can help cover the cost of repairs or replacement of the vehicle and medical expenses for those injured.

Secondly, Detroit has a high rate of car theft and vandalism, which can result in significant financial loss for car owners. Having comprehensive car insurance can help protect against such losses, providing coverage for theft, fire, and damage from natural disasters.

Additionally, Detroit has mandatory car insurance laws, which require all drivers to carry a minimum amount of liability coverage. Failure to comply with these laws can result in penalties, fines, and even the suspension of driving privileges. Thus, having adequate car insurance is essential for legal compliance and avoiding potential legal issues.

In summary, car insurance can provide financial protection, peace of mind, and legal compliance for drivers in Detroit, making it a highly beneficial investment for car owners in the city.

What does it require to insure a car?

Insuring a car typically involves several steps, including:

Choose an insurance company: Research and compare different insurance companies to find one that meets your coverage needs and budget.

Select a coverage type: Consider the type and level of coverage you need based on your car, driving habits, and personal circumstances. Common types of coverage include liability, collision, and comprehensive insurance.

Provide personal information: To obtain a quote, you’ll need to provide personal information such as your name, address, age, and driving history.

Provide car information: You’ll also need to provide information about your vehicle, including the make, model, year, and mileage.

Determine coverage limits: Decide on the coverage limits you want, which refers to the maximum amount your insurance will pay for a covered claim.

Pay the premium: Once you’ve chosen your coverage and limits, you’ll need to pay your premium. The premium is the amount you pay for your insurance policy, typically on a monthly or annual basis.

Receive proof of insurance: Once you’ve paid your premium, your insurance company will provide you with proof of insurance, which you’ll need to carry with you while driving.

Average Cost of Car Insurance in Detroit

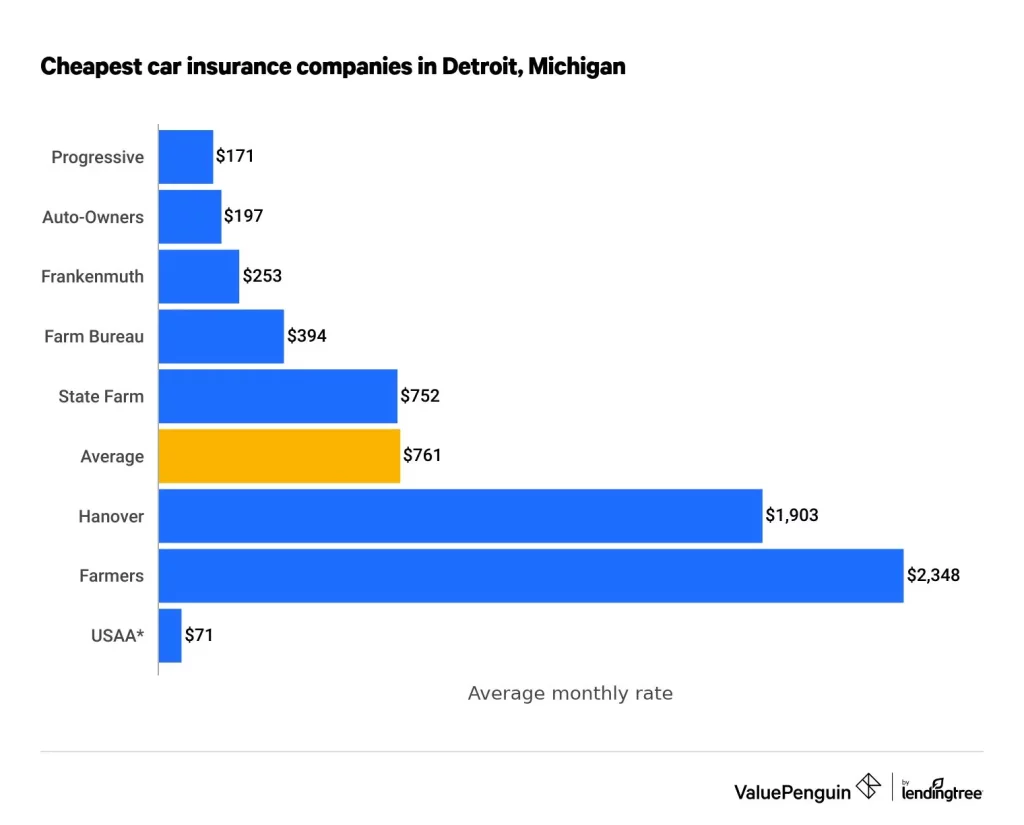

The average cost of car insurance in Detroit can vary depending on several factors, such as the driver’s age, driving record, type of vehicle, and coverage levels. However, according to recent data, Detroit has some of the highest car insurance rates in the country.

The average annual cost of car insurance in Michigan, which includes Detroit, was $2,878, which is significantly higher than the national average of $1,674. Additionally, Detroit has been ranked as the most expensive city in the country for car insurance, with an average annual premium of over $5,400 for full coverage.

Several factors contribute to Detroit’s high car insurance rates, including the city’s high population density, high rates of car theft and vandalism, and frequent car accidents. However, drivers can take steps to reduce their car insurance costs by comparing quotes from different insurance providers, choosing a higher deductible, and maintaining a safe driving record.

Is car insurance expensive in Detroit Michigan?

Michigan is the most expensive state for auto insurance. On average, drivers pay $3,688 per year for a policy meeting state minimums — nearly 300% higher than the national median rate.

Best Car Insurance Firms in Detroit

Sure, here’s some more information about the top car insurance firms in Detroit:

Auto-Owners Insurance:

Auto-Owners Insurance is a highly-rated insurance company that has been in business since 1916. They offer various coverage options, including liability, collision, and comprehensive insurance. They are known for their excellent customer service, and they have received high ratings for claims handling and customer satisfaction.

Progressive:

Progressive is a popular car insurance company that offers a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their competitive pricing and discounts, such as safe driver discounts and bundling discounts. They also offer a range of digital tools and resources for managing your policy and filing claims.

State Farm:

State Farm is one of the largest car insurance companies in the country, and they offer a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their strong financial stability and excellent customer service. They also offer a range of discounts, such as safe driver discounts and multiple vehicle discounts.

Allstate:

Allstate is another large car insurance company that offers a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their comprehensive coverage options and innovative tools and resources for managing your policy and filing claims. They also offer a range of discounts, such as safe driver discounts and multiple policy discounts.

The Hartford:

Hartford is a car insurance company that specializes in coverage for drivers over 50 years old. They offer a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their excellent customer service and comprehensive coverage options, including options for roadside assistance and rental car reimbursement.

AAA Michigan:

AAA Michigan is a car insurance company that is affiliated with the American Automobile Association. They offer a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their excellent customer service and roadside assistance programs. They also offer a range of discounts, such as safe driver discounts and multiple policy discounts.

Esurance:

Esurance is a car insurance company that specializes in online coverage options. They offer a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their competitive pricing and easy-to-use online tools and resources for managing your policy and filing claims.

GEICO:

GEICO is a popular car insurance company that offers a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their competitive pricing and discounts, such as safe driver discounts and bundling discounts. They also offer a range of digital tools and resources for managing your policy and filing claims.

Liberty Mutual:

Liberty Mutual is a large car insurance company that offers a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their strong financial stability and excellent customer service. They also offer a range of discounts, such as safe driver discounts and multiple policy discounts.

MetLife:

MetLife is a car insurance company that offers a range of coverage options, including liability, collision, and comprehensive insurance. They are known for their strong financial stability and excellent customer service. They also offer a range of discounts, such as safe driver discounts and multiple policy discounts.

In summary, these are some of the top car insurance firms in Detroit, based on factors such as customer satisfaction, financial stability, and coverage options. It’s important to compare quotes from multiple companies and read reviews to find the best coverage at the most affordable price.

It’s important to note that the specific requirements and process for insuring a car may vary depending on the state and insurance company.