For the most current and accurate details, it’s essential to consult an insurance professional or visit the official website of the Arkansas Insurance Department.

Car insurance in Arkansas, like in most states, is required by law. All drivers must have a minimum level of liability insurance to cover potential damages they may cause in an accident. As of September 2021, the minimum liability coverage requirements in Arkansas were as follows:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $25,000 per accident.

These minimum coverage amounts are often referred to as “25/50/25” coverage.

Arkansas also requires uninsured motorist coverage, which helps protect you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

The minimum uninsured motorist coverage limits were the same as the liability limits mentioned above.

While these are the minimum requirements, many drivers opt for higher coverage levels to provide more significant financial protection in the event of a severe accident.

Additionally, there are other types of car insurance coverage you can consider, such as collision coverage (to pay for damage to your vehicle) and comprehensive coverage (to cover non-collision-related damages like theft, vandalism, or natural disasters).

Insurance rates can vary based on factors such as your driving history, the type of vehicle you own, your location, and other personal factors. To find the best car insurance policy that suits your needs and budget, it’s advisable to shop around and compare quotes from different insurance providers.

Average Rates of Car Insurance in Arkansas

The average rates for car insurance in Arkansas can vary depending on several factors, including the driver’s age, driving history, location, type of vehicle, coverage levels, and the insurance company. It’s important to note that car insurance rates can change over time, so the figures provided here are for reference only.

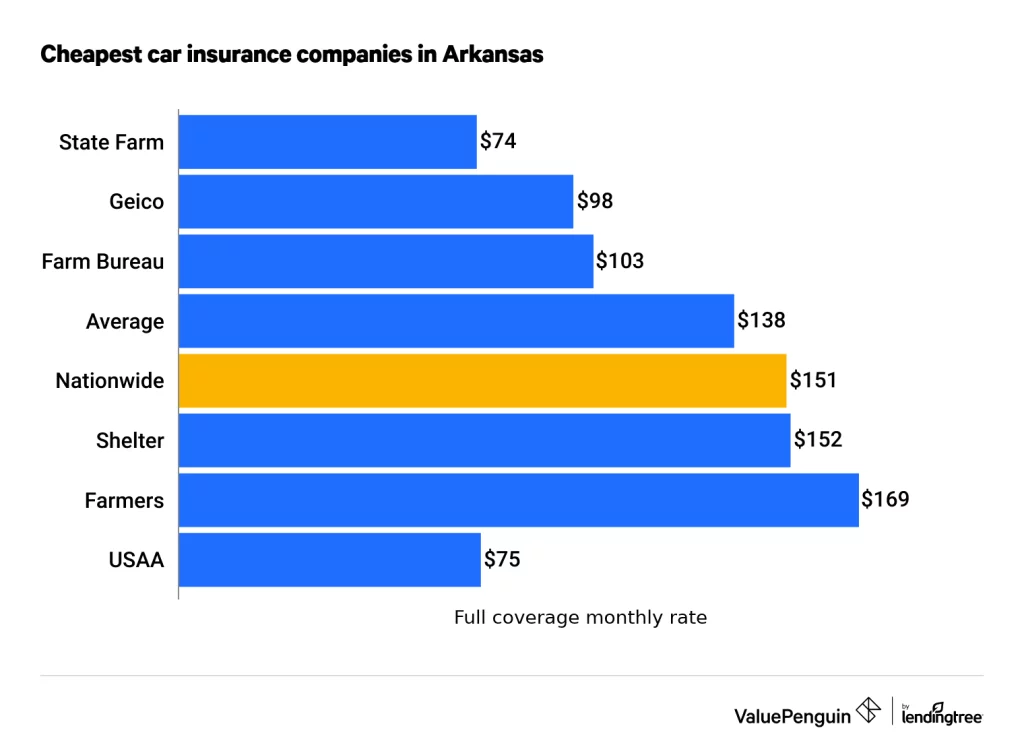

The average cost of car insurance in Arkansas is $1,189 annually, ranking 27th among all states. Since it is $235 lower than the national average of $1,424 per year, Arkansas is relatively affordable for auto insurance.

To get the most accurate and up-to-date information on car insurance rates in Arkansas, I recommend obtaining quotes from multiple insurance providers. This will allow you to compare prices and find the best coverage and rates that suit your specific circumstances.

When requesting quotes, remember to provide consistent and accurate information to each insurer to get reliable comparisons. Also, inquire about any available discounts that you might be eligible for, as these can help reduce the overall cost of your car insurance policy.

As car insurance rates can be influenced by various factors, it’s best to contact insurance companies directly or use online comparison tools to get personalized quotes tailored to your individual situation.

Benefits of Car Insurance in Arkansas

Car insurance in Arkansas, like in any other state, offers several important benefits for both drivers and the general public. These benefits help ensure financial protection and promote safe driving practices. Here are some of the key benefits of having car insurance in Arkansas:

Financial Protection:

Car insurance provides financial coverage in case of an accident, theft, vandalism, or other covered events.

It helps pay for the cost of repairs to your vehicle or the other party’s vehicle, medical expenses, and property damage.

Without insurance, you would be personally liable for these costs, which can be significant and cause financial hardship.

Liability Coverage:

Liability insurance is mandatory in Arkansas and helps cover damages you may cause to others in an accident.

This coverage protects you from having to pay out of pocket for injuries or property damage resulting from your negligence while driving.

Uninsured/Underinsured Motorist Coverage:

This coverage protects you in case you are involved in an accident with a driver who has little or no insurance coverage.

It helps cover your medical expenses and property damage if the at-fault driver lacks sufficient insurance.

Legal Compliance:

Car insurance is required by law in Arkansas. Having the minimum required coverage ensures that you comply with state regulations, helping you avoid potential legal penalties and fines for driving uninsured.

Peace of Mind:

Knowing that you have car insurance provides peace of mind while driving. You can focus on the road without worrying about the financial consequences of an accident, theft, or other covered incidents.

Protection against Unforeseen Events:

Car accidents and unforeseen incidents can happen at any time. Having car insurance protects you from the unexpected and helps mitigate the financial burden that could arise from such events.

Medical Payments Coverage:

Car insurance may include medical payments coverage, which pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

Additional Coverage Options:

In addition to the mandatory coverage, car insurance in Arkansas offers various optional coverage options.

These may include collision coverage, comprehensive coverage, rental car reimbursement, roadside assistance, and more. You can tailor your policy to suit your specific needs and preferences.

Overall, car insurance is essential for drivers in Arkansas as it provides vital financial protection, ensures compliance with the law, and promotes responsible driving behavior.

To find the best coverage for your needs, it’s advisable to compare insurance policies and consult with insurance providers to determine the most suitable options for you.

Best Car Insurance Companies in Arkansas

Please note that the availability of specific insurers and their policies may vary depending on your location and other factors. It’s essential to conduct your research and obtain personalized quotes from multiple insurers to find the best coverage for your needs. Here are some major insurance companies that typically operate in Arkansas:

- State Farm

- Website: www.statefarm.com

- Customer Service: 1-800-STATE-FARM (1-800-782-8332)

- GEICO

- Website: www.geico.com

- Customer Service: 1-800-861-8380

- Progressive

- Website: www.progressive.com

- Customer Service: 1-800-776-4737

- Allstate

- Website: www.allstate.com

- Customer Service: 1-800-ALLSTATE (1-800-255-7828)

- Farmers Insurance

- Website: www.farmers.com

- Customer Service: 1-888-327-6335

Please keep in mind that this is not an exhaustive list, and there are other insurance companies operating in Arkansas that may also provide excellent coverage and services. Additionally, regional or local insurance companies may offer competitive options in the state.

To find the most suitable car insurance company for your needs, be sure to compare quotes, policy options, and customer reviews from various insurers. You can also reach out to insurance agents or brokers in your area for personalized assistance in finding the right coverage for you.