Car insurance is a necessity for every driver on the road in order to protect themselves, their passengers, and their assets.

In Arizona, car insurance is mandatory, meaning that all drivers are required by law to carry a minimum level of coverage.

Arizona’s minimum liability coverage requirements are $15,000 for bodily injury or death of one person, $30,000 for bodily injury or death of two or more persons, and $10,000 for property damage.

However, many drivers opt for higher levels of coverage to provide additional protection.

Arizona car insurance policies can vary widely in terms of coverage, cost, and provider.

There are a multitude of car insurance companies operating in Arizona, each offering a range of coverage options and pricing.

Some providers specialize in offering affordable policies for drivers with a history of accidents or violations, while others cater to drivers seeking comprehensive coverage and additional benefits.

Choosing the right car insurance policy can be a daunting task, but it is crucial for protecting your financial well-being in the event of an accident.

Understanding the basics of car insurance in Arizona is an important first step in making an informed decision about coverage.

In this context, working with a licensed insurance agent or broker can be helpful to navigate the options available and to tailor a policy that fits the driver’s specific needs.

How much does Car Insurance Cost in Arizona on average

The cost of car insurance in Arizona can vary widely based on several factors, including the driver’s age, driving record, type of car, coverage level, and location.

According to recent data from the National Association of Insurance Commissioners, the average annual cost of car insurance in Arizona is around $1,300.

However, this is just an average, and individual costs can vary widely depending on the above-mentioned factors.

For example, a driver with a clean driving record and a safe car may pay less than someone with a history of accidents or violations and a sports car.

Similarly, a driver who opts for minimum liability coverage may pay significantly less than someone who chooses a higher level of coverage.

It’s also important to note that car insurance rates can vary by location within Arizona. Some areas, such as highly populated cities, may have higher rates due to increased risk of accidents or theft.

To get a more accurate idea of how much car insurance will cost for a specific driver and vehicle, it’s best to obtain quotes from multiple insurance providers. This can be done by contacting insurance companies directly or working with an insurance agent or broker.

What Benefits a user will get after car insurance

Car insurance provides several benefits to the policyholder, including:

- Financial Protection: Car insurance protects the policyholder from financial losses in the event of an accident or theft. The insurance company will cover the cost of damages to the policyholder’s car and property, as well as injuries to the driver and passengers.

- Liability Coverage: In Arizona, car insurance is mandatory and liability coverage is required by law. Liability coverage helps to protect the policyholder from lawsuits and legal fees in the event that they are responsible for an accident that causes property damage or bodily injury to another person.

- Peace of Mind: Knowing that you have car insurance can give you peace of mind while driving, knowing that you are financially protected in case of an accident or theft.

- Optional Coverage: In addition to liability coverage, car insurance providers offer a range of optional coverage options, including collision coverage, comprehensive coverage, and roadside assistance. These additional coverage options can provide additional protection and peace of mind to the policyholder.

- Discounts: Car insurance providers may offer discounts for safe driving, good grades, multiple policies, or other factors. These discounts can help to lower the cost of car insurance and provide additional savings for the policyholder.

Overall, car insurance provides essential protection and peace of mind for drivers on the road, helping to mitigate financial losses and providing important coverage in case of an accident or theft.

Best Car Insurance Companies in Arizona

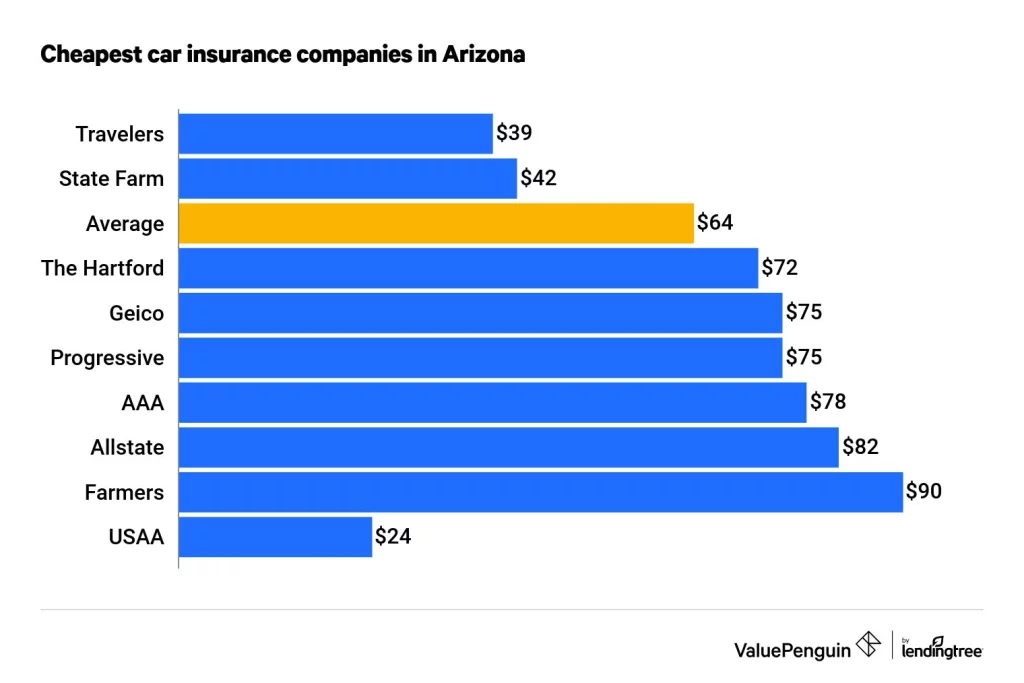

There are several car insurance companies that operate in Arizona, each with its own strengths and weaknesses. Some of the best car insurance companies in Arizona, based on customer satisfaction ratings and financial strength, include:

USAA:

USAA is a highly-rated car insurance company that specializes in serving military members and their families. The company consistently receives high marks for customer satisfaction and financial strength.

State Farm:

State Farm is one of the largest car insurance providers in Arizona and offers a range of coverage options, including liability, collision, and comprehensive coverage. State Farm also has a large network of agents and excellent customer service.

Geico:

Geico is known for its affordable rates and easy-to-use online platform. The company offers a range of coverage options and discounts for safe driving and other factors.

Farmers Insurance:

Farmers Insurance is a well-established car insurance provider in Arizona with a strong reputation for customer service. The company offers a range of coverage options and discounts for good driving, multiple policies, and other factors.

Progressive:

Progressive is a popular car insurance provider in Arizona with a reputation for innovative products and competitive rates. The company offers a range of coverage options, including liability, collision, and comprehensive coverage, as well as discounts for safe driving and other factors.

Ultimately, the best car insurance company for an individual in Arizona will depend on their unique needs and preferences. It’s important to compare coverage options, rates, and customer reviews from multiple providers to make an informed decision.