Keep in mind that policies, rates, and regulations may have changed since then, so it’s essential to verify the information with up-to-date sources.

In Utah, like in most states, car insurance is mandatory. Drivers are required to carry liability insurance coverage to help cover costs in case they are at fault in an accident that causes injury or property damage to others.

The minimum liability insurance requirements in Utah are as follows:

$25,000 bodily injury coverage per person

$65,000 bodily injury coverage per accident (when multiple people are injured)

$15,000 property damage coverage per accident

Keep in mind that these are just the minimum requirements, and it’s often advisable to consider higher coverage limits to adequately protect yourself and your assets in case of a severe accident.

Aside from liability insurance, you may also want to consider additional types of coverage, such as:

Collision coverage: This helps cover the cost of repairs to your vehicle after an accident, regardless of who is at fault.

Comprehensive coverage: This covers damage to your car caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

Uninsured/Underinsured motorist coverage: This protects you if you’re in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for your damages.

To get the most accurate and up-to-date information on car insurance in Utah, I recommend reaching out to local insurance providers and obtaining quotes tailored to your specific needs and circumstances. Be sure to compare different policies and coverage options to find the one that best fits your requirements and budget.

Average Cost of Car Insurance in Utah

The average cost of car insurance in Utah can vary significantly depending on various factors, including age, driving history, location, type of vehicle, coverage limits, and other personal circumstances. Insurance premiums are determined based on the level of risk you present as a policyholder.

While I don’t have access to real-time data, according to previous reports and industry averages, the average annual cost of car insurance in Utah is approximately $1,100 to $1,300. However, it’s important to note that this is just an estimate, and individual rates may be higher or lower based on the factors mentioned earlier.

Additionally, keep in mind that these figures represent the average cost across all drivers in Utah, and your specific premium may differ significantly from this average. To get a more accurate idea of what you might pay for car insurance, it’s recommended to obtain quotes from multiple insurance providers and consider factors that are specific to your situation.

Remember that insurance companies use various rating factors and formulas to calculate premiums, so the best way to get an accurate quote is to contact insurance companies directly and provide them with the necessary information.

Types of Cars and their Average Insurance

The cost of car insurance can vary depending on several factors, including the type of car you drive. Insurance companies consider various factors when determining insurance premiums for different car models. Some common factors that can affect the insurance cost for a particular vehicle include:

Value and Cost of Repairs: Luxury cars or vehicles with high market values typically have higher insurance premiums because the cost of repairs or replacement parts can be expensive.

Safety Ratings: Cars with higher safety ratings and advanced safety features may have lower insurance premiums due to their reduced risk of accidents and injuries.

Theft Rates: Vehicles that are frequently targeted by thieves may have higher insurance premiums because of the increased risk of theft or vandalism.

Performance and Horsepower: Sports cars or high-performance vehicles often have higher insurance rates due to their increased likelihood of being involved in accidents.

Crash Test Ratings: Vehicles with poor crash test ratings may have higher insurance premiums because they pose a higher risk of injuries to occupants.

Size and Weight: Larger and heavier vehicles may have lower insurance rates due to their potential to cause less damage in accidents.

It’s important to note that while these factors generally influence insurance premiums, the specific rates can vary between insurance companies. Additionally, individual driver characteristics, such as driving history, location, and age, will also impact the insurance cost.

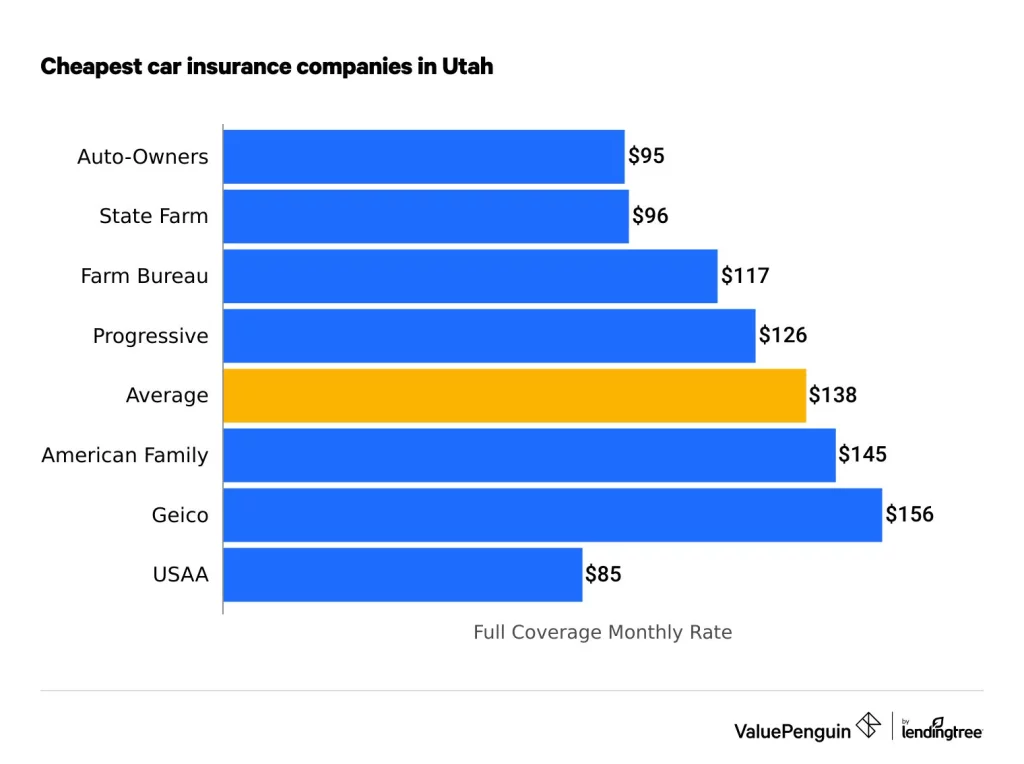

Best Car insurance Firms in Utah

While determining the “best” car insurance firm in Utah can be subjective and may depend on individual preferences and needs, several well-known and reputable insurance companies operate in the state. Here are some insurance firms that are frequently recognized for their services and customer satisfaction:

State Farm: State Farm is one of the largest car insurance providers in the United States and offers a wide range of coverage options. They have a strong presence in Utah and provide personalized customer service through their network of local agents.

Allstate: Allstate is another popular insurance company that offers a variety of coverage options and features, including accident forgiveness and new car replacement. They have a strong financial standing and provide 24/7 customer support.

Progressive: Progressive is known for its competitive rates and innovative features like the Snapshot program, which offers personalized rates based on driving habits. They provide a user-friendly online platform and a variety of coverage options.

Geico: Geico is well-known for its advertising campaigns and offers affordable rates for car insurance. They provide a streamlined online experience and 24/7 customer support.

USAA: USAA is a highly regarded insurance provider that primarily serves members of the military and their families. They consistently receive high customer satisfaction ratings and offer a range of insurance products, including car insurance, with tailored benefits for military personnel.

These are just a few examples of insurance companies operating in Utah. It’s important to research and compare multiple insurance providers to find the one that best suits your needs, offers competitive rates, and provides excellent customer service. Additionally, consider reading customer reviews and consulting with local agents to gather more information about their services in Utah.