Car insurance in Montana, like in other states, is a legal requirement for all drivers. Montana law mandates that all drivers carry liability insurance to cover any damages or injuries they may cause in an accident. Here are some key points regarding car insurance in Montana:

Liability Insurance:

Montana requires drivers to carry liability insurance with minimum coverage limits of 25/50/20. This means your policy should have at least $25,000 coverage for bodily injury per person, $50,000 coverage for bodily injury per accident, and $20,000 coverage for property damage per accident.

Uninsured/Underinsured Motorist Coverage:

Montana also requires uninsured/underinsured motorist coverage (UM/UIM). This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. The minimum limits for UM/UIM coverage are the same as the liability limits mentioned above.

Additional Optional Coverages:

While liability insurance and UM/UIM coverage are mandatory in Montana, there are other optional coverages you may choose to add to your policy. These include comprehensive coverage (which covers damage to your vehicle from non-collision incidents like theft or vandalism) and collision coverage (which covers damage to your vehicle from collisions).

Proof of Insurance:

You must carry proof of insurance whenever you drive in Montana. This can be in the form of an insurance card provided by your insurer or an electronic copy on your smartphone. If you’re pulled over by law enforcement or involved in an accident, you’ll need to present this proof.

Penalties for Non-Compliance:

Failing to carry the required insurance in Montana can result in penalties and fines. These penalties can include license suspension, vehicle registration suspension, and reinstatement fees.

Shopping for Car Insurance:

When shopping for car insurance in Montana, it’s important to compare quotes from multiple insurance companies to find the coverage that best suits your needs. Factors that can affect your insurance premiums include your driving record, the type of vehicle you drive, your age, and your location.

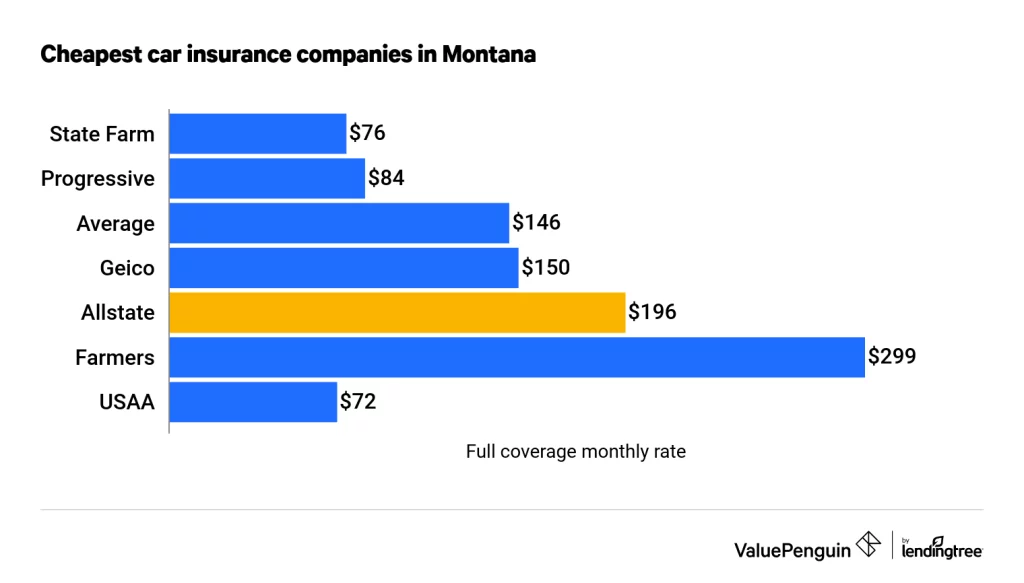

Average rates of Car Insurance in Montana

The average rates for car insurance in Montana can vary depending on several factors, including your age, driving record, location, type of vehicle, coverage limits, and other personal details. Insurance premiums are unique to each individual, so it’s challenging to provide an exact average rate. However, I can provide a rough estimate based on some general data.

The average cost of car insurance in Montana comes out to $1,938 per year or $162 per month for full coverage. That’s about 12% higher than the national average of $1,730 per year or $144 per month. It costs an average of $456 per year or $38 per month for minimum coverage car insurance in Montana

It’s important to note that insurance rates can change over time, and they can vary significantly between different individuals. Factors such as a clean driving record, good credit history, low mileage, and taking advantage of discounts can help lower your insurance premiums.

To get a more accurate estimate of car insurance rates in Montana, it’s recommended to contact insurance companies directly and request quotes based on your specific circumstances and coverage needs. Insurance companies consider a wide range of variables when determining premiums, so obtaining personalized quotes is the best way to get an accurate estimate.

Best Car Insurance Companies in Montana

Several car insurance companies operate in Montana, and the best one for you may depend on your specific needs and preferences. However, here are some well-known insurance companies that have a strong presence in Montana and are often recognized for their quality coverage and customer service:

State Farm:

State Farm is one of the largest car insurance providers in the country and offers a wide range of coverage options. They have a strong presence in Montana and are known for their reliable customer service.

Farmers Insurance:

Farmers Insurance is another reputable insurance company that provides coverage in Montana. They offer various insurance options, including auto insurance, and have a solid reputation for customer satisfaction.

GEICO:

GEICO is known for its competitive rates and user-friendly online tools. They often provide affordable car insurance options and have a straightforward claims process.

Progressive:

Progressive is recognized for its innovative policies and numerous discounts. They offer customizable coverage options, including usage-based insurance programs like Snapshot, which can help save money based on your driving habits.

Allstate:

Allstate is a well-known insurance company that provides comprehensive coverage options for drivers in Montana. They have a wide range of policy offerings and offer various discounts to help drivers save on premiums.

It’s important to note that insurance needs vary, so it’s advisable to compare quotes and coverage options from multiple insurance companies to find the one that best suits your requirements.