Car insurance in Minnesota is regulated by the state government and follows certain requirements and guidelines. If you own a vehicle in Minnesota, it’s important to understand the car insurance laws and coverage options to ensure compliance and protection.

Here are some key points regarding car insurance in Minnesota:

Liability Insurance:

Minnesota law requires all drivers to carry liability insurance. The minimum liability coverage limits are:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident involving more than one person

- $10,000 for property damage per accident

These limits represent the minimum required coverage, but it’s often recommended to have higher coverage to provide better protection.

No-Fault Insurance:

Minnesota follows a no-fault system for car insurance. This means that regardless of who is at fault in an accident, each party involved in the accident is responsible for their own medical expenses and other damages. Personal Injury Protection (PIP) coverage is mandatory and helps cover medical expenses, lost wages, and other related costs resulting from an accident.

Uninsured/Underinsured Motorist Coverage:

Minnesota requires drivers to have uninsured/underinsured motorist coverage (UM/UIM). This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage to pay for damages.

Additional Optional Coverage:

While liability, PIP, and UM/UIM coverage are mandatory in Minnesota, you can also consider optional coverage to enhance your protection. Some common optional coverages include collision coverage (for damage to your vehicle in an accident), comprehensive coverage (for damage caused by non-accident events like theft, vandalism, or weather), and rental car coverage.

Proof of Insurance:

Minnesota law requires drivers to carry proof of insurance in their vehicles at all times. The proof of insurance can be an insurance card or an electronic version displayed on a smartphone or other electronic device.

Penalties for Non-Compliance:

Failure to carry the minimum required insurance in Minnesota can result in penalties, including fines, license suspension, and vehicle impoundment.

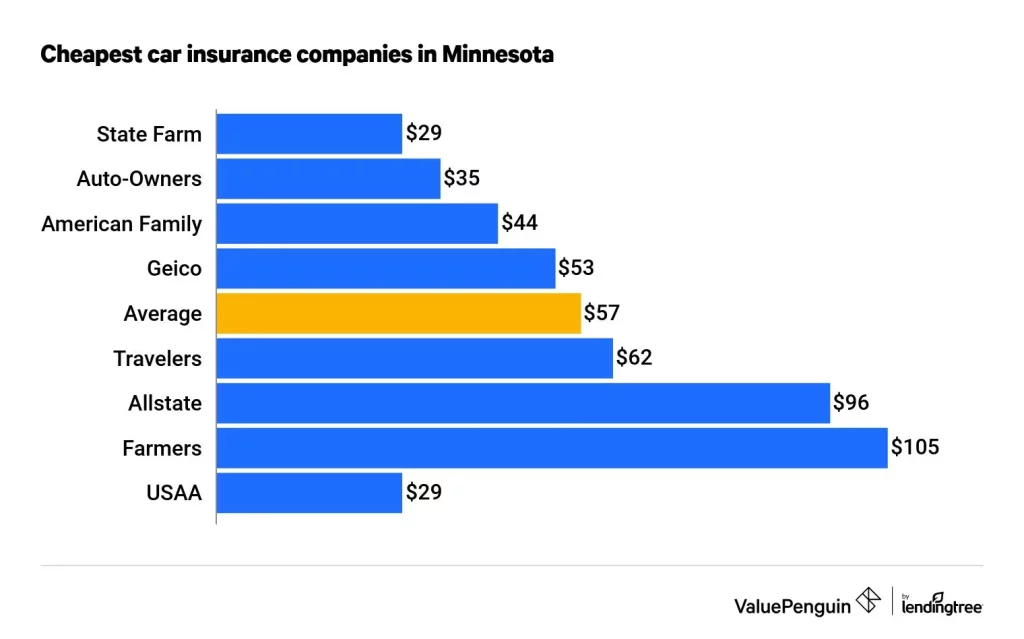

Average Cost Car Insurance in Minnesota

The average car insurance premium in Minnesota can vary depending on several factors, including your age, driving record, the type of vehicle you own, your location within the state, and the coverage limits you choose. Therefore, it’s difficult to provide an exact average cost. However, I can provide you with some general information.

According to data from the National Association of Insurance Commissioners (NAIC), the average cost of car insurance in Minnesota is for 2023. Minnesota drivers pay an average rate of $585 for minimum coverage and $1,760 for full coverage car insurance.

It’s important to remember that this is just an average, and your actual premium may be higher or lower based on your specific circumstances. To get an accurate quote tailored to your situation, it’s recommended to contact insurance providers and obtain quotes.

Factors such as your age, driving history, credit score, coverage choices, and the insurance company’s underwriting guidelines will all impact the final premium you are quoted. Shopping around and comparing quotes from multiple insurance companies will help you find the best coverage at a competitive price.

When shopping for car insurance in Minnesota, it’s advisable to obtain quotes from multiple insurance providers and compare coverage options, deductibles, and premiums. You can contact insurance companies directly or work with an independent insurance agent to help you find the best coverage for your needs.

Best Car Insurance Companies in Minnesota

There are several reputable car insurance companies operating in Minnesota. While the “best” company can vary based on individual needs and preferences, here are some of the well-regarded car insurance providers in Minnesota:

State Farm:

State Farm is one of the largest car insurance companies in the country and is known for its extensive coverage options, competitive rates, and excellent customer service. They have a strong presence in Minnesota and offer various discounts to policyholders.

Geico:

Geico is known for its affordable rates and user-friendly online platform. They provide a wide range of coverage options and discounts, making them a popular choice among many Minnesota drivers.

Progressive:

Progressive is recognized for its innovative insurance offerings, including usage-based insurance programs like Snapshot. They offer competitive rates and provide a range of coverage options and discounts to policyholders.

Farmers Insurance:

Farmers Insurance is well-established in Minnesota and offers comprehensive coverage options for car insurance. They have a network of agents throughout the state who provide personalized service to policyholders.

Allstate:

Allstate is a reputable insurance company known for its extensive coverage options and excellent customer support. They offer a variety of discounts and have a strong presence in Minnesota.

American Family Insurance:

American Family Insurance, also known as AmFam, provides auto insurance coverage tailored to individual needs. They offer competitive rates, discounts, and options for personalized coverage.

Liberty Mutual:

Liberty Mutual is known for its customizable policies and numerous coverage options. They offer various discounts, including multi-policy and safe driver discounts, to help policyholders save on premiums.

USAA:

USAA is a highly regarded insurance provider that caters to military members, veterans, and their families. They are known for their exceptional customer service and comprehensive coverage options.

Travelers:

Travelers Insurance offers a range of coverage options and discounts for Minnesota drivers. They provide personalized service and have a strong financial standing.

Nationwide:

Nationwide is a well-established insurance company that offers a variety of coverage options and discounts. They have a network of agents in Minnesota and provide personalized support to policyholders.

When choosing a car insurance company, it’s important to consider factors such as coverage options, customer service, financial stability, and pricing. Comparing quotes and researching customer reviews can help you make an informed decision based on your specific needs and preferences.