When it comes to car insurance in West Virginia, there are certain requirements and options you should be aware of. Car insurance is mandatory in West Virginia, and all drivers must carry a minimum level of coverage to legally operate a vehicle in the state.

Here are the basic types of car insurance coverage required in West Virginia:

- Liability Insurance: You must have liability insurance that covers bodily injury and property damage. The minimum liability coverage limits in West Virginia are:

- $25,000 for bodily injury or death per person.

- $50,000 for bodily injury or death per accident.

- $25,000 for property damage per accident.

- Uninsured/Underinsured Motorist Coverage: West Virginia also requires uninsured and underinsured motorist coverage. This type of coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage to pay for the damages. The minimum uninsured/underinsured motorist coverage limits in West Virginia are the same as the liability coverage minimums mentioned above.

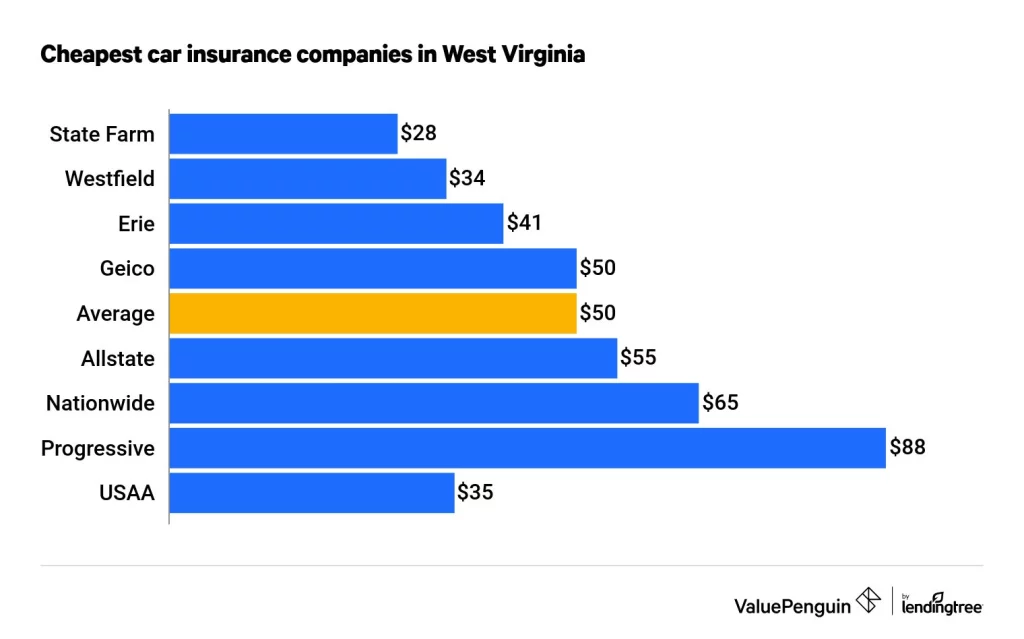

Average Cost of Car Insurance in West Virginia

Additionally, while not required, there are other optional coverage types that you might consider:

- Collision Coverage: This coverage pays for repairs to your vehicle in case of a collision, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage provides protection for damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, natural disasters, or hitting an animal.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers if injured in an accident, regardless of fault.

- Rental Reimbursement Coverage: If your car is being repaired after an accident, this coverage will reimburse you for the cost of renting a vehicle.

It’s important to shop around and compare quotes from different insurance companies to find the best coverage options and rates for your specific needs. Insurance premiums can vary based on factors such as your driving record, the type of vehicle you own, your location, and the coverage limits you choose.

Remember to review your policy carefully, ask any questions you may have, and ensure you understand the terms, conditions, and coverage limits before making a decision.

Benefits of Car Insurance

Car insurance offers several benefits and serves as crucial financial protection for drivers. Here are some of the key benefits of having car insurance:

- Financial Protection: Car insurance provides financial protection in the event of an accident or damage to your vehicle. It helps cover the cost of repairs or replacements, medical expenses, and property damage caused to others involved in the accident. Without insurance, you would be responsible for paying these expenses out of your own pocket, which can be financially devastating.

- Liability Coverage: Liability coverage is a fundamental part of car insurance. It protects you from legal liabilities if you cause an accident that results in injury or property damage to others. It covers the costs of legal defense, settlements, or court judgments against you, providing peace of mind and protecting your assets.

- Protection Against Uninsured/Underinsured Drivers: Car insurance often includes coverage for accidents involving uninsured or underinsured drivers. If you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage, your insurance can help cover your medical expenses and property damage, ensuring you’re not left with the burden of the costs.

- Medical Coverage: Many car insurance policies offer medical coverage that pays for your medical expenses resulting from an accident, regardless of fault. This can include hospital bills, doctor’s fees, and rehabilitation costs. Medical coverage is especially important if you don’t have health insurance or have limited coverage.

- Vehicle Protection: Car insurance can provide coverage for your own vehicle, including repairs or replacement in the event of damage from accidents, theft, vandalism, or natural disasters. This can save you a significant amount of money and ensure you can get back on the road quickly.

- Additional Benefits and Services: Car insurance policies often come with additional benefits and services. These may include roadside assistance, rental car reimbursement, towing services, and coverage for personal belongings inside the vehicle. These services can be valuable in emergency situations and help you navigate unexpected circumstances.

It’s important to note that the specific benefits and coverage options can vary depending on the insurance policy and the choices you make. When selecting car insurance, carefully review the terms and coverage details to ensure you have the protection you need.