Car insurance is a type of insurance that provides financial protection for drivers and their vehicles in case of accidents or other types of damage.

The insurance policies typically offer several different types of coverage, including liability, collision, comprehensive, and personal injury protection.

Liability coverage is typically the most basic type of car insurance and covers damages that you cause to other people and their property in an accident.

Collision coverage covers damages to your own vehicle in the event of a collision, regardless of who is at fault.

Comprehensive coverage provides protection for non-collision events, such as theft, vandalism, or natural disasters.

Personal injury protection covers medical expenses and lost wages for you and your passengers in case of an accident, regardless of who is at fault.

Car insurance policies can vary widely in terms of coverage options, deductibles, and premiums. Factors such as age, driving history, and the type of car you drive can also affect the cost of car insurance.

It’s important to review your car insurance policy and understand your coverage limits and deductibles before an accident occurs, so you know what benefits you’re entitled to receive.

Benefits of Car Insurance After Accident

Car insurance can provide several benefits after an accident, depending on the type of coverage you have. Here are some of the benefits of car insurance after an accident:

- Financial protection: If you’re involved in an accident, car insurance can provide financial protection by covering the cost of damages to your vehicle, as well as any injuries or property damage you cause to others.

- Repair or replacement of your vehicle: If your car is damaged in an accident, your car insurance may cover the cost of repairs or replacement of your vehicle, depending on the type of coverage you have.

- Coverage for medical expenses: If you or your passengers are injured in an accident, car insurance may cover the cost of medical expenses, including hospital bills, doctor’s visits, and rehabilitation.

- Liability coverage: If you’re at fault for an accident, liability coverage can protect you from being personally responsible for the cost of damages or injuries caused to others.

- Legal protection: Car insurance can also provide legal protection by covering the cost of legal fees and court costs if you’re sued after an accident.

- Peace of mind: Having car insurance can provide peace of mind knowing that you’re financially protected in case of an accident. It can also help you avoid legal issues and penalties associated with driving without insurance.

It’s important to review your car insurance policy and understand your coverage limits and deductibles before an accident occurs, so you know what benefits you’re entitled to receive.

Get Quote for a Car Insurance in Virginia

The easiest and most convenient way to get a car insurance quote is to visit the websites of various insurance providers that operate in Virginia.

Most insurance providers have an online quote tool that allows you to enter your information and receive a quote within minutes. Alternatively, you can call an insurance agent directly or visit their office to get a quote.

To get an accurate quote, you’ll need to provide some information about yourself and your car, including your age, driving history, vehicle make and model, and desired coverage levels. Be sure to have this information handy when you’re getting a quote.

It’s also a good idea to get quotes from multiple insurance providers and compare their rates and coverage options.

This can help you find the best deal and ensure that you’re getting the coverage you need at a price you can afford.

Remember that the cost of car insurance in Virginia varies depending on various factors, and the quote you receive may be higher or lower than the state average.

Be sure to ask about any discounts or savings opportunities that you may be eligible for to lower your insurance premium.

Average Cost of Car Insurance in Virginia

The average cost of auto insurance in Virginia varies depending on several factors, such as age, driving history, type of car, location, and coverage levels.

However, according to the National Association of Insurance Commissioners (NAIC), the average annual auto insurance premium in Virginia in 2018 was $758. This is significantly lower than the national average of $1,004.

It’s important to note that this is just an average, and your individual insurance premium may be higher or lower than this depending on your specific circumstances.

For example, if you have a poor driving history or own an expensive car, your insurance premium may be higher than the state average.

On the other hand, if you have a good driving record and are eligible for discounts, you may be able to get a lower premium.

To get an accurate estimate of how much you can expect to pay for auto insurance in Virginia, it’s best to get quotes from multiple insurance providers and compare their rates and coverage options.

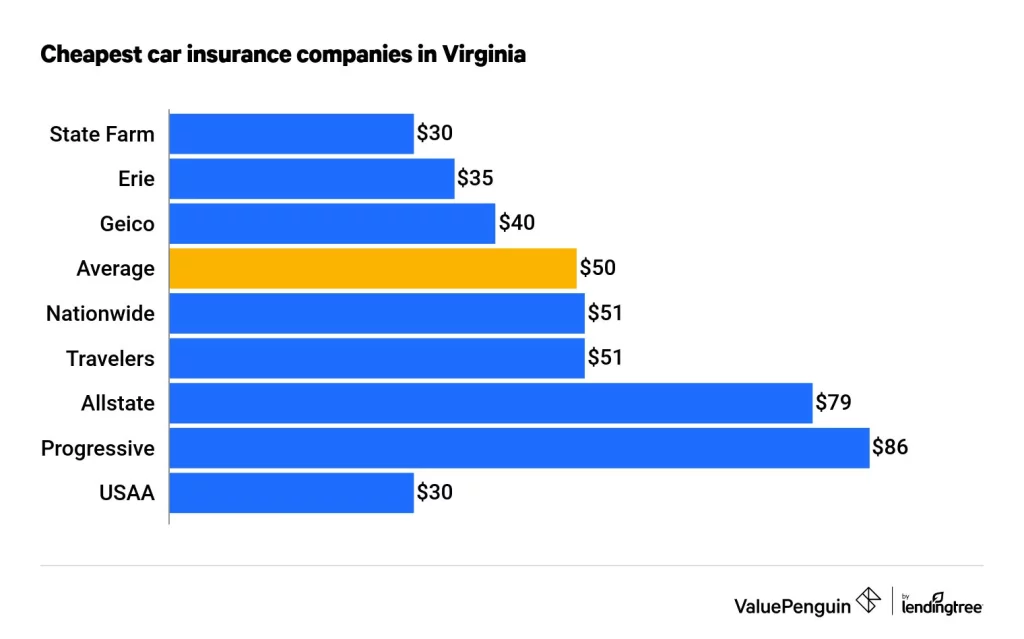

Best Car Insurance Companies in Virginia

There are many car insurance companies operating in Virginia, and the “best” one for you will depend on your specific needs and preferences. However, based on various factors such as customer satisfaction ratings, financial strength, and coverage options, the following are some of the top car insurance companies in Virginia:

USAA:

USAA consistently ranks as one of the best car insurance providers in Virginia and nationwide. However, it’s only available to military members, veterans, and their families.

Erie Insurance:

Erie Insurance is a regional insurance provider with a strong reputation for excellent customer service, affordable rates, and comprehensive coverage options.

Nationwide:

Nationwide is a well-known car insurance company with a broad range of coverage options, including liability, collision, and comprehensive coverage, as well as roadside assistance.

Geico:

Geico offers competitive rates, customizable coverage options, and excellent customer service. They also offer a wide range of discounts, such as safe driver discounts, military discounts, and student discounts.

State Farm:

State Farm is one of the largest car insurance providers in Virginia and the country, offering a wide range of coverage options, including liability, collision, and comprehensive coverage, as well as rental car coverage and roadside assistance.

Remember that these are just a few of the many car insurance companies operating in Virginia. Be sure to do your research and compare rates, coverage options, and customer reviews before making a decision.